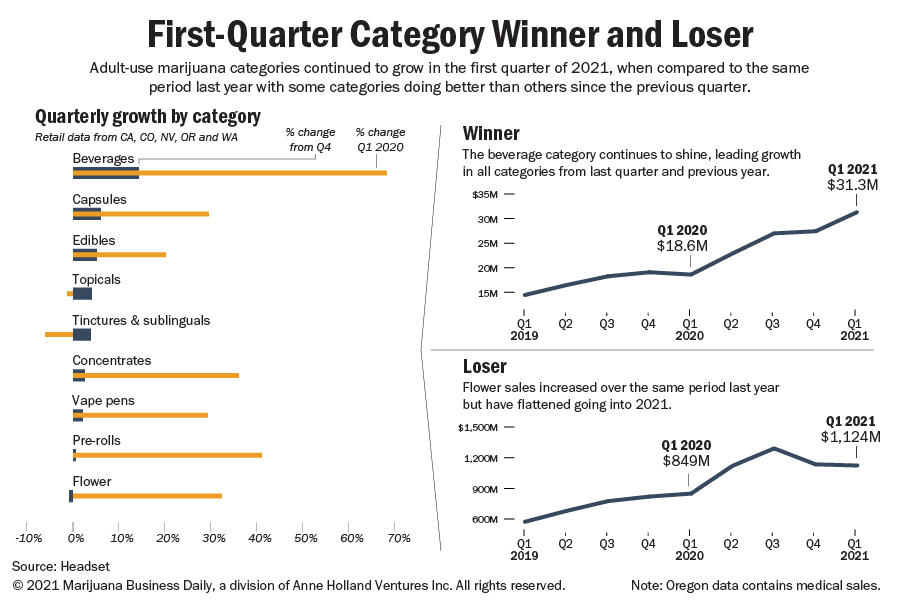

Sales data and trends just released by Headset. Covers last 12 months, latest quarterly Adult-use Cannabis sales figures for California, Colorado, Nevada, Oregon (incl. medical) and Washington state. COVID influence is apparent.

Of the alternative methods of consumption (Edibles, beverages, topicals, tinctures, capsules) the Beverages category displayed the most growth (68.4%) in year-on-year & quarter-by-quarter comparisons, continues to maintain an upward trend. (To put that in perspective – a trend in a category attracting 3% of the revenue compared to flower sales.)

All sales lifted after the introduction of COVID measures. Flower sales reached a peak in Q3 followed by a slight decline (1%) in growth by Q4. Flower sales grew 32% (US$245M) over the 12 months from Q1 20 (US$ 879M) to Q1 21 (US$ 1,124M)

Maybe it is, because there are no surprises in the data, that they embellish their articles with hyperbole.

It’d be click bait if it was in the title!

e.g. in their intro of the situation, speaking only in % growth “…

Retail sales data for California, Colorado, Nevada, Oregon and Washington state – provided by Seattle-based analytics firm Headset – showed clear winners, including beverages, capsules and edibles.

The data also showed lackluster <sp> sales performances for vapes, pre-rolls and flower…

The beverage category continued to shine in the first quarter, leading all categories with sales growing 68.4%.”

They wait until the last paragraph to put lackluster sales performance into perspective and give the real value of that lacklustre performance ($245M for flower vs $12.7M for beverage).

“…It would be premature to call flower a loser as it continues to grow year-over-year and still commands the largest share of the market.For comparison, beverage sales for the states analyzed were $31.3 million in the first quarter of 2021, while flower sales totaled $1.1 billion.

Here at CLR we thought we’d have a quick squizz through too and also noticed the MJ Biz comment…

| Pre-rolls | Cannagars / Blunts | 3.9% | 200.4% |

| Pre-rolls | Connoisseur / Infused | 10.9% | 154.4% |

| Pre-rolls | Mixed Strain | 67.8% | 181.1% |

In flower also, which as terrier points out is still by far and away the market leader for product.

Even with a slightest of overall flattening of sales over a couple of quarters, a couple of product ranges are showing very healthy growth indeed in % change from Q1 2020

| Flower | Ground Flower | -12.4% | 575.9% |

| Flower | Specialty / Infused | 4.2% | 143.0% |

So why the push on Beverages ?

What’s that all about as we start to return post pandemic to on site events and conferences?

Here’s the article

Sales of adult-use marijuana products continued to grow in the first quarter of 2021 versus the same period last year with some categories such as beverages posting particularly strong gains.

Retail sales data for California, Colorado, Nevada, Oregon and Washington state – provided by Seattle-based analytics firm Headset – showed clear winners, including beverages, capsules and edibles.

The data also showed lackluster sales performances for vapes, pre-rolls and flower.

The beverage category continued to shine in the first quarter, leading all categories with sales growing 68.4% over the same period last year and 14.2% versus the fourth quarter of 2020.

Most beverage categories experienced double-digit growth going into 2021.

Iced tea, lemonade, and fruit drinks topped the category with 26.7% growth over the previous quarter and 144.35% versus the same period last year.

- Tea, coffee and hot cocoa: 16.1% over previous quarter

- Carbonated beverages: 14.7% over previous quarter

- Water: 12.1% over previous quarter

- Drops, mixes, elixirs and syrups: 11.4% over previous quarter

Edibles and capsules were also clear category winners, with both showing at least 5% growth over the previous quarter and 20% or more versus the first quarter of 2020.

Vape and pre-roll categories showed the least growth, with flower actually posting a decline.

While flower sales grew 32.4% over the first quarter of last year, they declined almost 1% versus the fourth quarter of 2020.

On the positive side, flower’s small drop flattens a downward trend for the category: Flower sales declined 12% in the fourth quarter after spectacular gains of 32% in the second quarter of 2020 and 15% in the third quarter that were driven largely by the COVID-19 pandemic.

It would be premature to call flower a loser as it continues to grow year-over-year and still commands the largest share of the market.

For comparison, beverage sales for the states analyzed were $31.3 million in the first quarter of 2021, while flower sales totaled $1.1 billion.

Andrew Long can be reached at andrew.long@mjbizdaily.com.

Percent change adult-use marijuana categories

Overall marijuana categories have grown since last year. A look at how specific segments within those categories have done. Data contains adult-use retail sales from California, Colorado, Nevada, Oregon and Washington state. Oregon numbers contain medical sales. Source: Headset

Source: