by Teri Buhl

The CEO of Sol Global Investments, Andy Defrancesco and his ex-wife Catherine Defrancesco, have been named as defendants in a conspiracy scheme involving the stock of a hot cannabis IPO, Verano, that went public this month.

The lawsuit involves half a billion dollars that Canadian hedge fund MMCap has asked the Ontario court to help take possession of because of contractual rights they hold on the stock of Verano.

The Defrancescos’ are named in the lawsuit because in 2019 they signed personal guarantees to back a $50 million loan issued by 1235 fund lp, an affiliate of MMCap, issued to cash-strapped Sol Global Investments.

The lawsuit filed this week also details how Andy Defrancesco was warned in writing that Sol Global was filing misleading financial reports intended for the investing public with a Canadian securities exchange as far back as November 2020.

MMCap fund is run by Matt MacIssac and Hillel Meltz. The fund is known for asset backed lending with double digit returns for investors. According to the statement of claims filed in the commercial list department of an Ontario court, Andy Defrancesco came to MMCap in the summer of 2019 after a series of failed investments left Sol Global cash poor and with bad credit. No one would lend Sol Global money and outside investors had dried up after Defrancesco was named as being part of a scheme to manipulate the stock of Aphria.

So MMCap, via 1235 Fund Lp, agreed to a hail-Mary loan and gave the company a $50 million loan that didn’t have to be paid back for two years with only 6% interest. The interest payments were set for $1.5 million to be paid semi-annually, according to the debt agreement reviewed by Cannabis Law Report.

MMCap says they agreed to these terms because their signed contract also had an equity option clause that said the fund could be paid in stock of a then private company called Verano Holdings.

Verano Holding is run by George Archos and has acquired cannabis distribution and dispensary licenses in multiple U.S. states. Sol Global first invested at least $88 million USD in Verano back in 2018 when Defrancesco thought he could sell a new cannabis farm Sol Global owned in Florida called 3 Boys Farms. But Verano and Archos backed out of deal after due diligence started and Sol Global was stuck with spending all their cash on an investment in privately held Verano. Sol Global ended up holding 3.3 million class B shares of the private company via two llc’s Defrancesco created for tax avoidance purposes called Verano Blocker 1 and Verano Blocker 2, according to the the lawsuit. The Verano llc’s are owned by Sol Global Investments.

Then Verano and Harvest Health planned a merger at the end of 2019 making the Verano shares possibly worth something to Sol Global which had no other profitable income, according to the lawsuit. During this time Andy Defrancesco and his puppet CEO Brady Cobb touted the Verano shares as a highly valuable asset for Sol Global. But then the Verano-Harvest deal was called off in the spring of 2020. During this time Sol Global was also defaulting on making timely interest payments to MMcap and according to the contract put their debt deal into default thus triggering an event for MMcap to call in the collateral backed on the loan. That collateral was the Verano shares.

In the fall of 2020 a new deal emerged. Verano was now going to go public via a reverse take over with a company called Majesta Minerals and the new stock ticker would be $VRNO. To sweeten the deal Verano and another cannabis company called AltMed agreed to merge. Bay Street and Wall Street valued the blockbuster deal at $3 billion because Verano was actually turning a profit as a privately held company.

Verano Holdings began trading on the CSE on February 17, 2021. The IPO price was $10 CAD but with significant interest in cannabis stocks after the U.S. election the stock flew to a high of $33 CAD in its opening days of trading.

Defrancesco’s Manipulation Scheme

At the beginning of November, 2020 Sol Global’s stock was trading on the OTC Markets below one dollar USD. Then Andy Defrancesco began to talk up Sol Global’s ownership of millions of Verano stock and how those shares could covert to triple digit millions for Sol Global.

The company even changed its description of how the MMcap debt deal was structured in their MD&A filing with the Canadian Stock Exchange alluding to the notion that their MMcap loan wasn’t backed by Verano shares anymore, according to the lawsuit and public filings.

In November, Sol Global’s stock began to climb. The stock doubled from January 29th to February 16th because of the Verano IPO with $SOLCF closing at a high of $5.11 USD.

Andy Defrancesco even went as far to say on social media just days before the Verano IPO that Sol Global’s conversion of New Verano shares would net Sol Global 25.2 million shares. And the market watched the Verano IPO thinking that Sol Global owned 25.2 million new Verano shares valued at a price of over $30 CAD giving it a net windfall of tipple digit millions.

In fact main street investors in the U.S. who didn’t have a Canadian account to buy Verano shares were encourage by stock promoters to buy Sol Global on the OTC Markets instead to get a piece of the Verano IPO windfall.

But according to the new lawsuit filed by Sol Global’s lender most of what Andy Defrancesco was saying on social media and to broker dealers, along with what Sol Global said in their public financial statements, just wasn’t grounded in fact.

The lawsuit lays out how Sol Global and Defrancesco filed a lawsuit in New York state court on February 7th accusing MMcap of trying to steal Sol Global’s Verano shares. But Defrancesco and his attorney at Quinn Emanuel, Alex Sipro, knew MMcap had a secured contract with an equity option that enabled 1235 Fund to demand 2,163,493 million in private Verano shares. That secured collateral would be 65% of the shares Sol Global could convert to free trading New Verano shares. The lawsuit says if Sol Global had honored the terms of the contract 1235 Fund would have had 16 million new Verano shares. And with an IPO high of $33 CAD that would amount to MMcap’s 50 million investment turning into a cash out of over $500mn CAD.

Sol Global was warned about MMcap’s intention to take the Verano shares as payment for the loan at the end of November 2020. Then MMcap even sent a letter personally to Andy Defrancesco on December 4th to make sure he knew what they were asking the company for. MMcap also warned they would use the Canadian courts if necessary to secure the shares.

At this point Defrancesco, while signing a personal guarantee in case Sol Global would be unable to pay back the loan and the Verano shares were worthless, also agreed to litigate any issues in the deal in Canada. The contract says Sol Global or Defrancesco would have to pay MMcap’s attorney fees.

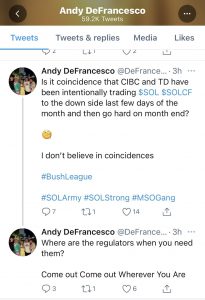

The lawsuit details how Defrancesco has used the NY state court system to spread misleading and false information about who actually owns the Verano shares because he knew early on that MMcap was going to sue him and the truth about how much money Sol Global would really make on the Verano deal would come out in the wash. Defrancesco has now gone on to tell people privately that MMcap is shorting his company’s stock and this is why they are suing him. He has also tweeted publicly to investors questioning if broker dealers like TD Ameritrade or CIBC should be allowed to sell short positions in Sol Global Investments. A move that could be part of Defrancesco’s misinformation campaign.

1235 Fund is asking the court to put the new Verano shares of at least 16 million into an escrow account and their contract allows for the appointment of a receiver. In case Defrancesco had assigned those valuable Verano shares to others on Bay Street he owes money to, or early investors in any of his deals, MMcap can come after his and his ex-wife’s personal wealth.

Since the Verano deal Defrancesco has been bragging to Bay St he made over $100 million on this deal, according to a source who is familiar with his thinking. It’s unclear if Catherine Defrancesco, who owns yoga studios in South Florida, even knows she signed a document securing her personal wealth to the MMcap loan.

MMcap also got a corporate guarantee from Delavaco Holdings another company Andy Defrancesco controls. The lawsuit details how Andy Defrancesco uses Catherine’s name on corporate documents but that he is the person in control of companies like Delavaco and Sol Global.

MMcap went as far to warn Sol Global and Defrancesco, via letters from their attorney, that the company was making false and misleading statements in public filings intended for investors and has asked the court to impose punitive damages against Sol Global for what reads like a claim of market manipulation.

It’s unclear how much or if any of this evidence has been turned over to Canadian or U.S. securities regulators.

The Defrancescos did not respond for comment as of press time. MMcap when reached through their public relations firm said they would not comment beyond what was written in the lawsuit. Cannabis Law Report obtained the lawsuit via a request to the Ontario Court. Fund 1235 is being represented by Kent Thomson and Steven Frankel of Toronto-based DAVIES WARD PHILLIPS & VINEBERG LLP.

The litigation is going to ask the courts to stay the New York lawsuit Sol Global filed because the contract doesn’t allow them to sue in the U.S. and Sol Global could be forced to pay MMcap’s legal fees for filing a frivolous lawsuit. 1235 Fund lp could also ask for sanctions against Sol Global’s US attorney Alex Sipro for filing a vexing lawsuit.

THE 1235 Fund Lawsuit

1235 fund vs Defrancesco Sol Global Feb 2021