May 17, 2019|INTERNAL REVENUE CODE, 401(K), CANNABIS, LEGAL CANNABIS PRODUCTION, INDUSTRIAL HEMP, IRS, DEPARTMENT OF LABOR, HEMP, DOL, ERISA, CONTROLLED GROUP, TAX, JEWELL LIM ESPOSITO, 280E, CBD, MARIJUANA

May 19, 2019

Cannabis company participation in 401(k) plans is a complicated and confusing matter.

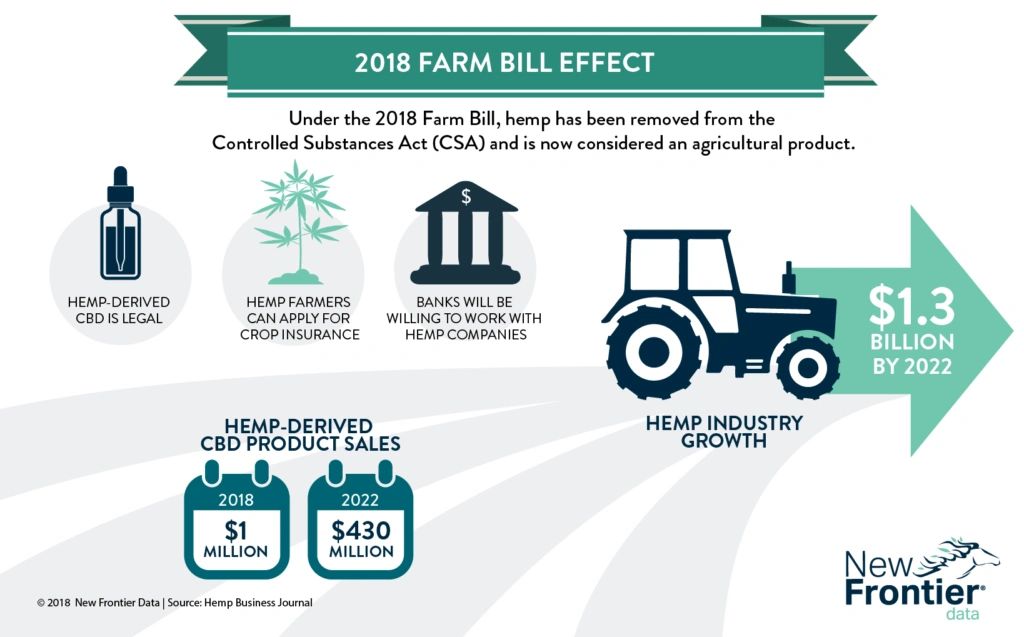

The matter is attracting increasing (and maybe both equally panicked and excited) attention as a result of cannabis-related statutory changes with the December 2018 Farm Bill that President Trump signed into law. These changes have to do with definitions that now treat low-THC cannabis products such as hemp and CBD as industrial hemp, rather than as controlled substances under the Controlled Substance Act.

There are approximately 300,000 employees in the legal cannabis industry. The Internal Revenue Code expressly permits cannabis employees to participate in a retirement plan just like other, non-cannabis employees. (For some background, see last month’s blog post on the IRS’s acknowledgment of permissible cost of goods sold adjustments tied to pension and profit sharing plan contributions in “Cannabis and 401(k) Participation”).

The participation of cannabis employees in 401(k) plans, however, has not been without its issues, particularly when they engage in activities that constitute criminal trafficking federally, despite being legal at a state level.

Fear and Loathing on Wall Street: The Trafficking Issue

The real obstacle to implementing 401(k) plans for otherwise legal marijuana producers are the industry retirement plan providers who are nervous and jittery about dealing with “traffickers.”

In fact, they’re more than nervous. They have dug in their heels, refusing to do business with cannabis companies technically engaged in trafficking under federal law. Here below are some unequivocal truths:

- Cannabis companies are legally able to adopt 401(k) plans. Again, see the ERISA/Tax support in a related post.

- The United States Attorney General is on record with the stated intent to refrain from pursuing trafficking prosecutions against otherwise legally-operating cannabis companies.

It stands to reason that — for protection and insulation from fallout liability — a retirement plan provider might demand representations and warranties to confirm that the cannabis companies with which it wants to do business are legally operating.

The major retirement industry players are not persuaded, these above truths notwithstanding. At present, many retirement plan service providers — think: brokerages, wire houses, third party administrators (TPAs), recordkeepers, custodians, corporate trustees, CPAs, and even attorneys — will not deal with these cannabis companies when, in fact, the Internal Revenue Code provides authority for their 401(k) participation.

The reluctance here, however understandable, is unfortunate for the Cannabis and Hemp/CBD Industry.

Clearing the Smoke: ERISA, Tax, and Controlled Group Rules

With the Farm Bill now as law, the 401(k) game has changed, and retirement plan service providers should pivot and be ready (and willing) to respond to the Cannabis and Hemp/CBD Industry.

The Farm Bill provides a critical component of the solution to the 401(k) plan access problem for cannabis companies who are deemed traffickers. Essentially, the bill alters the definition of marijuana to exclude the cannabis plant’s buds, leaves, and germinating seeds (and products extracted from them, such as CBD) as long as their THC content falls below a threshold of 0.3 percent. These products are now termed “hemp” or “industrial hemp” (and I will later refer to a company cultivating and selling industrial hemp as a “HempCo” company; in contrast, I will refer to a marijuana producer (a trafficker) as a “CannaCo”).

Hemp is Off the List

Hemp, as newly defined, has come off Schedule I of the Controlled Substance Act, making it an ordinary agricultural commodity. Section 280E of the Internal Revenue Code no longer impacts hemp production. While producers will be regulated pursuant to the Farm Bill, HempCos are no longer committing the federal crime of trafficking, and there is no bar to claiming normal business deductions or obtaining 401(k) plan services from industry providers.

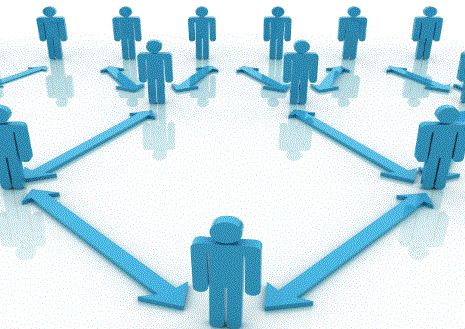

With HempCos and their employees allowed to be in the 401(k) space, there is a legal mechanism through which CannaCos and their employees may participate in 401(k) plans by way of HempCos. That mechanism is the long-established Internal Revenue Code concept of the controlled group, an entity comprised of two or more companies or businesses under common control and connected by ownership (either a parent-subsidiary relationship or a brother-sister relationship).

Even in the Cannabis and Hemp/CBD industry, the key characteristic of the controlled group is that the employers in the group are deemed to be a single employer for purposes of ERISA, tax, and benefit plan qualification, including many non-discrimination tests. Such tests seek to determine whether, among other things, highly compensated employees are favored or benefited at the expense of other employees. In a controlled group, the tests extend to all employees of the deemed single employer.

“Single Employer” Concept Allows Cannabis and Hemp to be in Same 401(k) Plan

The coverage test (under Section 410(b) of the Internal Revenue Code) is critical to the “single employer” concept.

A hypothetical (though these similar company structures exist in the Cannabis/Hemp/CBD Industry):

1. There is a Canada parent company “CanadaParent” who has two wholly-owned subsidiaries in the United States.

2. Those two companies are HempCo and CannaCo.

3. Under tax rules, CanadaParent, HempCo, and CannaCo are part of the same controlled group.

4. Under tax rules, HempCo and CannaCo are brother-sister.

Note: Similar organizational structures will be of concern too with the likely eventuality (?) of a non-cannabis company (who has a 401(k) plan) owning a significant percentage of or having enough common ownership in the corporate stock of a cannabis company (who is not yet participating in a 401(k) plan, likely in violation of discrimination rules). That is a blog post for another day.

Advisers to Cannabis Companies Cannot Afford to be Wrong in Their Advice

Let’s assume — as the law permits — that HempCo sponsors its own HempCo 401(k) Plan for employees in the United States. Let’s further assume that the HempCo 401(k) Plan fails the required annual coverage test.

Beware: this is a typical failure, and one over which cannabis consultants (financial advisers, CPAs, TPAs, health insurance sellers,ERISA professionals, attorneys, etc.) should not be remiss. With the very automatic operation of applicable tax rules, a head-in-the-sand, this-is-too-taboo approach will underserve or mis-guide the very Cannabis and Hemp/CBD companies that yearn for guidance that only experts in the retirement industry can provide.

The Tax Code Provides the Authority for Cannabis and Hemp/CBD to Share in a 401(k) Plan

The Internal Revenue Code itself provides the solution on how to cure the HempCo 401(k) Plan’s (and the management/fiduciary obligation to correct the) failure of this particular test.

Existing tax law effectively forces CannaCo to have its United States employees participate in the HempCo 401(k) Plan. That is because both CannaCo and HempCo are a deemed “single employer.” If CannaCo’s employees are not permitted to participate (and/or do not coordinate their own non-discriminatory 401(k) plan), then HempCo violates ERISA and various Internal Revenue Code provisions.

Tax Rules Require the IRS to Allow Cannabis Employees to Participate in a 401(k) Plan

It seems incongruous that the IRS can use the Tax Code to impose income tax on illegally earned (trafficking) income, but not use the 401(k) rules within that same Tax Code to permit retirement plan savings for Cannabis/Hemp/CBD companies.

Moreover, the IRS itself would be in a position to require that HempCo force the participation of CannaCo under tax rules to ensure non-discrimination. That not-so-absurd result then finds the Hempco/CannaCo single employer having to contribute money on behalf of CannaCo employees as a required correction for those who had been impermissibly excluded.

Further, with a failed coverage test that remains uncorrected, the IRS could deny otherwise legitimate tax benefits to HempCo. That is, the IRS could (1) disallow deductions on the corporate return of HempCo; (2) require income tax on the amounts employees contribute; (3) disallow the tax-deferred growth on earnings inside the accounts of HempCo 401(k) employee participants; (4) prohibit the ability of HempCo 401(k) participants to roll over their money in a tax-free distribution; etc.

It’s very important to note that the penalties result not due to trafficking, but rather due to the operation of the Internal Revenue Code.

Department of Labor Rules Require the Government to Ensure Cannabis Employees are Protected and can Participate in a Proper 401(k) Plan

The Department of Labor, as well, would have ample authority to contend that the failure to extend the HempCo 401(k) plan to the CannaCo employees was a fiduciary breach and improper administration of the 401(k) plan document provisions (and governing law). As the DOL notes on its website: “[A fiduciary] must follow the terms of plan documents to the extent that the plan terms are consistent with ERISA.” Such a fiduciary breach could lead to personal liability.

Even if these HempCos and CannaCos want to provide competitive benefits for their 300,000 employees, they both will find it hard to comply with ERISA, Tax, and Controlled Group Rules if the retirement plan industry service providers remain reluctant to serve an industry that is in desperate need of assistance and clarity.

The Future of Hemp and Cannabis 401(k) Participation

In removing hemp from the ambit of the Controlled Substance Act, the Farm Bill makes it possible for hemp producers in the industry to take advantage of 401(k) plans and various federal tax credits and accelerated tax deductions without having to worry about the impact of section 280E of the Internal Revenue Code. The industry will continue to grow with such incentivization and so will the employee population at HempCos across the United States. Meanwhile, their CannaCo counterpart companies will also grow.

It’s fair and just (and not to mention, the law under the Internal Revenue Code and ERISA) that all employees within controlled groups in the Cannabis and Hemp/CBD Industry access 401(k) plans, the tensions between federal and state laws notwithstanding.

* * *

Learn more about what the lawyers in our Cannabis, Hemp, & CBD Practice Group are doing with companies in the industry by reviewing some of our most recent transactions.

Author Bio

Jewell Lim Esposito offers decades of in-the-trench practical experience in the Employee Benefits/Tax legal world. She further sub-specializes in Title I (Department of Labor fiduciary issues) and Title II (IRS tax qualification issues) under the Employee Retirement Income Security Act (ERISA). Ms. Esposito’s strength is understanding the business and demographics of her clients, who are headquartered across the nation. That is, with her practice being federal law, the location of the US client needing ERISA/Tax guidance on tax compliance and fiduciary duties is immaterial.

She advises in “plain English,” even when the issues are complex and is able to size up exposure for C-suite executives to help them select an optimal Tax and ERISA strategy. The range of Ms. Esposito’s practice extends to work in the areas of government pension plans, Executive Compensation, the Affordable Care Act, COBRA, health and welfare fringe/prevailing wage under the Service Contract Act and Davis-Bacon, and ERISA prohibited transaction exemptions.

In the area of cannabis/hemp/CBD, Ms. Esposito counsels associations, member companies, and growers/distributors/dispensaries/license holders on how Section 280E of the Internal Revenue Code affects their payroll, 401(k), health benefits, and insurance deductions. She currently chairs and coordinates her firm’s efforts in showcasing all the legal services already provided to the Cannabis, Hemp, and & CBD industry and in education related to marijuana use to the general workplace.

Ms. Esposito is the editor of and contributing author to the AllThingsERISA blog.