That tells you something about the world we’re moving into…..

OKLAHOMA CITY (KOKH) – January Gross Receipts dropped by almost 6% compared to monthly collections from January of last year in the largest one-month revenue reduction in eight months.

Collections from all sources in January total $1.19 billion, down by $72.1 million.

“Oklahomans have demonstrated remarkable strength and resiliency during the past year, but the state economy is clearly not immune to the fiscal impact caused by the pandemic,” Treasurer McDaniel said. “Even so, we continue to anticipate recovery as public health improves and economic activity increases.”

Collections from the gross production tax on crude oil and natural gas has fallen by nearly 35% during the month.

Combined sales and use tax receipts rose above prior year collections by $8.1 million.

https://oklahoman.com/article/5661717/oklahoma-cannabis-industry-smashes-record-monthly-sales-number-in-april

January collections

- Total January 2021 gross collections are $1.19 billion, down $72.1 million, or 5.7%.

- Gross income tax collections, a combination of individual and corporate income taxes, generated $432.4 million, down by $37.9 million, or 8%.

- Individual income tax collections are $381.5 million, a decrease of $30.8 million, or 7.5%.

- Corporate collections are $50.9 million, down by $7 million, or 12.2%.

- Combined sales and use tax collections, including remittances on behalf of cities and counties, total $506.4 million – up by $8.1 million, or 1.6%.

- Sales tax collections total $415.1 million, a decrease of $156,089, or 0.04%.

- Use tax receipts, collected on out-of-state purchases including internet sales, generated $91.2 million, an increase of $8.3 million, or 9.9%.

- Gross production taxes on oil and natural gas total $57.5 million, a decrease of $30.8 million, or 34.9%.

- Motor vehicle taxes produced $64.5 million, down by $1.5 million, or 2.3%.

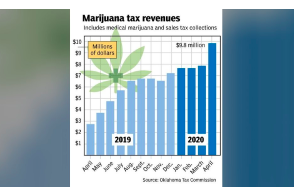

- Other collections composed of some 60 different sources including taxes on fuel, tobacco, medical marijuana, and alcoholic beverages, produced $126.2 million – down by $10 million, or 7.3%.

- The medical marijuana tax produced $5.2 million, up by $2 million, or 59.7%.