SPLIT DOWN THE MIDDLE

Of late, Florida’s green boom has nothing to do with golf or traditional stereotypes of the Sunshine State, such as stoned retirees and staunch Republicans. In my opinion, it seems that MedMen didn’t get the memo, or they’re busy playing golf.

• • • • • • • • • • • • • •

SHORT HONEYMOON?

MedMen—

MedMen operate a number of upscale cannabis dispensaries in California, Nevada, New York, Florida, and other select states, went public at the end of May after buying the British Columbia-based Ladera Ventures.

Acquisitions soon followed: in October, MedMen acquired the medical-marijuana dispensary chain PharmaCann in a $682 million all-stock transaction that almost doubled the combined firm’s footprint overnight.

• • • • • • • • • • • • • •

TROUBLE IN PARADISE?

MedMen—

MedMen’s stock then tumbled down from $3.25 to about $0.30, and subsequently, the company’s monumental $682 million merger with PharmaCann fell apart in October 2019.

MedMen promptly followed this collapse by laying off about 40% of its corporate workforce in November and December 2019.

• • • • • • • • • • • • • •

HOPE IN SIGHT?

MedMen—

Meanwhile, Ganjapreneur’s TG Branfalt highlighted the following on October 16, 2019:

Two of Florida’s high-priced medical cannabis licenses are up for sale for a proposed $95 million — $40 million for one, $55 million for the other (which includes a greenhouse and a higher allowance for retail locations).

Two Florida medical cannabis licenses are for sale totaling $95 million, the Tampa Bay Times reports. One $40 million license allows for up to 30 retail stores, while the other $55 million license allows up to 35 and includes a greenhouse.

The licenses are being brokered by Aubrey Logan-Holland, the CEO of Atlanta, Georgia-based firm Blue Dream Industries.

“Whoever acquires this asset will get a chance to stake their claim in one of the biggest medical markets in the world. It’s a good state to do business.” – Logan-Holland, to the Miami Herald, via the Times

Florida’s medical cannabis industry is vertically integrated, which means the license holders are responsible for growing, processing, testing, and selling medical cannabis products.

Jeff Sharkey, lobbyist and director of the state’s Medical Marijuana Business Association, said that, to his knowledge, “all of” the state’s licenses “have been shopped” at some point but “the acquisitions are not as attractive as they were last year.”

According to this October 2019 report, there were about 270,000 medical cannabis patients in Florida registered and Arcview Market research estimates that the state’s industry is expected to generate $1.1 billion in annual revenue by 2022.

MedMen continued their Florida Expansion With Three New Stores in St. Petersburg, Key West and Pensacola— bringing their total to 29 operating stores nationally.

By the way, our qualified medical cannabis patient count in Florida currently stands at over 315,0000 according to the February 21, 2020 OMMU Weekly Update.

• • • • • • • • • • • • • ••

REVELATORY NAME CHANGE?

Surterra (Parallel)—

Simultaneously, Jim Kinney outlined how the Parent company of NETA marijuana shops changes name from Surterra Wellness to Parallel on Oct 07, 2019: “The parent company of New England Treatment Access, which operates medical and recreational marijuana stores in Northampton and Brookline, has changed its name from Surterra Wellness to Parallel. The Georgia-based company, which also operates marijuana businesses in Florida, Texas, and Nevada, bought NETA in January.”

In addition, PRNewswire alo reported that Surterra Wellness Announces Corporate Name Change to Parallel™:

Surterra Wellness today announced that it has changed its corporate name to Parallel™ effective today. Parallel, formerly Surterra Wellness, is a leading, global company that is pioneering human well-being through its proprietary cannabinoid brands and science- and technology-led innovation.

“The introduction of our new parent company brand, under the name Parallel, reflects our transformational growth over the past year and our long-term vision.

We need a corporate name that unites the diverse parts of our organization and all of our associates,” said William “Beau” Wrigley Jr, CEO and Chairman of Parallel.

“We chose the name Parallel because we are improving the well-being of our consumers today through our proprietary, innovative brands while at the same time stepping into the future through robust innovation.We like the name because we see well-being along a spectrum of what quality of life means to different people at different points of their lives, and our brands cover the full range of what they need.”

• • • • • • • • • • • • • •

WHAT’S IN A NAME?

Surterra (Parallel)—

As names go, “Parallel” packs quite a punch. Look at their first merger. On June 17, 2019, Jessica Bartlett highlighted how With Surterra acquisition, cannabis lab plans expansion. Dr. Jeff Karp, professor of medicine at Harvard Medical School, associate bioengineer at Brigham and Women’s Hospital, and faculty at Harvard-MIT Division of Health Sciences and Technology, Broad Institute and Harvard Stem Cell Institute, said Parallel is “helping lead a team to make a better marijuana product.”

MedMen—

On November 3, 2019, sure enough: Pensacola News Journal reported that MedMen Pensacola opens new dispensary on Bayou Boulevard. For non-local readers, to what is this newly-licensed Florida dispensary location parallel to, you may ask?

Location: 5048 Bayou Blvd, Pensacola, FL 32503, MedMen via Google

Surterra (Parallel)—

Directly parallel to Surterra, no pun intended.

Location: 5046 Bayou Blvd, Suite A, Pensacola, FL 32503, Surterra via Google

Coincidence? I think not.

• • • • • • • • • • • • • •

MEDICAL CANNABIS MARKET UP FOR GRABS?

MedMen—

This year has seen MedMen traveling down a rocky road. Jeremy Berke reported for Business Insider in January that Former CEO Bierman was the most recent to depart.

Before his exit, Bierman told Business Insider that “investors were right to punish MedMen’s stock. The investor community and the Street — they don’t really get anything wrong. If our stock is trading at a tremendous discount to our peer set, there’s a reason for it.”

MedMen’s CEO then proceeded to step down on February 1, 2020. As reported by Yeji Jesse Lee on February 27, 2020:

MedMen is discontinuing its Arizona operations — which includes three retail locations as well as cultivation and manufacturing operations. Company leaders also said they were evaluating whether to temporarily or permanently close other stores they think are not profitable. They are also in “active discussions with a number of parties” to spin off factories in different states, according to CFO Zeeshan Hyder.

In addition, marijuana Business Daily published an article on February 1st, 2020 reporting that “In a news release, MedMen said co-founder Andrew Modlin also has agreed to give up his super voting shares by December 2020.”

Surterra (Parallel)—

Jake Bergmann, Founder and former CEO of what are Surterra dispensaries throughout Florida, also stepped down in 2018.

Per PRNewswire, Surterra Wellness Announces Beau Wrigley as New CEO:

“Surterra Wellness Expanded from 100 to over 500 Employees in 2018.

Surterra Wellness (Surterra), one of the nation’s largest providers of medical cannabis, today announced that William “Beau” Wrigley Jr. will assume the role of Chief Executive Officer (CEO). Wrigley became Chairman of Surterra’s Board of Directors in August and has been closely involved with the company since September 2017. Jake Bergmann stepped down as CEO effective Monday, November 5, 2019.”

• • • • • • • • • • • • • •

MORE MERGERS AFOOT?

MedMen—

But as Debra Borchardt, Editor-in-Chief of Green Market Report reported in her January 23, 2020 interview with Bierman: “There have been plenty of times where roles have been reversed and we’ve been asked to be partners, long term partners to some of these groups. I think that’s just part of building an industry. There will be times when you’ll be asked to help others out in the industry. And there’ll be times when it’s vice versa.”

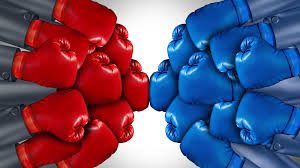

This sentiment was put to the test last fall as MadMen and Parallel joined forces in Florida to push through an adult recreational cannabis use petition for the 2020 ballot. Strange bedfellows indeed: apparent Florida competitors working together? Yet, here they are waking up next to each other in the morning.

• • • • • • • • • • • • • •

PARALLEL + MEDMEN: FUTURE SYNERGISTIC PARTNERS?

In December 2019 edition of Cannabis Business Times, Todd Williams, of Medicine Man Technologies advises “There can be all kinds of synergies, but if the cultures don’t come together, I think you’ve run into a roadblock that can derail a successful acquisition or merger.” Medicine Man Technologies has entered into agreements to become a vertically integrated seed to sale operator.

MedMen + Surterra (Parallel)—

Why is this “synergies factor” so important to this MedMen-Parallel story? Breakfast in bed comes with perks. In Florida, two giant medical cannabis companies who would seem to be rivals started working together on a petition to legalize adult recreational cannabis use in the state of Florida.

Because one of Parallel’s fellow Florida license-holders Surterra Is A Major Contributor In Push To Legalize Recreational Pot In Florida, as noted by News Service of Florida on October 11, 2019. What happened next will forever be part of Florida medical cannabis history: These 2 Cannabis Companies Kicked In Over $1 Million to Legalize Pot in Florida: Will Their Bets Pay Off?

Sure enough, a fast friendship emerged as MedMen, Parallel pump another $1.08M into adult-use pot initiative, wherein “The two companies are almost single-handedly funding the campaign.”

Surterra was a major donor to a campaign to legalize recreational marijuana in Florida, an effort that now is extended until the 2020 elections.

Another coincidence? I think not.

• • • • • • • • • • • • • •

REVELATORY FLORIDA DISPENSARY CHANGES?

MedMen—

When they first opened in Pensacola in November 2019, MedMen had cannabis delivery service available, to the delight of the community.

However, it was discontinued within a month due to non-compliance with State of Florida Department of Health regulation that only company cars can be used to make cannabis deliveries. Not sure how they missed that rule; it’s a big one.

According to the up-to-date, comprehensive medical cannabis patient resource FLDispensaries.com, a privately owned product menu and ordering app, MedMen Marijuana Deliveries RX – Remain UNAVAILABLE:

“MedMen delivery in Pensacola is currently unavailable. When they become active MedMen menu products will be available by delivery in Cantonment, Milton, Navarre and throughout Escambia County.

Please check back for their delivery status as well as MedMens medical marijuana products, menu, reviews, discounts and prices. Many of the Florida cannabis brands are delivering statewide.”

Surterra (Parallel)—

Delivery abruptly dissolved on January 15, 2020, but why? Focus on retail. On January 20, 2020, Jeff Smith of Marijuana Business Daily reported that Large Florida medical cannabis retailer stops most deliveries:

“Surterra Wellness, the second-largest owner of medical marijuana dispensaries in Florida, has eliminated its delivery services except to customers in the Florida Keys.

“The Atlanta-based company, whose corporate parent is now called Parallel, told customers in a notice that it made the adjustments to “optimize” its business. Surterra also cut deliveries because its expanding retail footprint now covers a broad swath of Florida’s population.

Company spokeswoman Kali Caldwell declined to disclose the number of employees affected by the decision.

“We are focusing our efforts on opening new stores in Florida,” Caldwell said in a statement.

“We currently operate 38 retail locations, and over the next year, we will grow that number to 50.”

Surterra is the second-largest seller in Florida of medical marijuana in milligrams but is sixth in smokable flower sales. The company’s dispensaries account for 17% of the state’s total, but its share of milligram sales is only 12.6% and smokable flower sales 5%, according to the state’s latest weekly update.”

Yet a third coincidence? Absolutely no way.

• • • • • • • • • • • • • •

MY OPINION?

Concerning the troubled MedMen retail stores and lack of delivery, coupled with Surterra’s hefty retail sales but dissolution of the delivery department, I believe there are three distinct theories. Here are my educated predictions for the future Florida dispensary marketplace, as well as the entire U.S. cannabis industry:

1. THEORY: THE OLD SWITCHEROO

I believe that MedMen, parallel to Surterra of Parallel parent company, will become a recreational cannabis retail location, and right next door, Surterra will remain open as a medicinal cannabis retail location, or vice versa.

This prediction is solely an educated guess based on the location of the buildings, the similarities of the company paths of action, and mutual benefits to each. Yes, the parent company name change to “Parallel” around the same time as MedMen canceled their acquisition of PharmCann indeed lends some credence to this theory, in my opinion.

Conversely, Surterra or MedMen could become a merged retail location and the other store location could become a delivery hub only. It’s plausible due to Theory 2 below.

2. THEORY: MERGER, ACQUISITION, or RTO

I believe that Surterra’s parent company Parallel will merge or acquire MedMen, or vice versa. Currently, neither location offer delivery, despite being adjacent or parallel to one another in Pensacola physical address.

Surterra is sitting in the catbird seat as far as retail medical cannabis sales are concerned.

According to the most recent weekly update published by Florida’s Office of Medical Marijuana Use on February 21st, 2020 with 39 locations dispensing over 8 million milligrams of (a) medical marijuana, (b) smoking marijuana, and (c) low THC cannabis combined– that’s only for the February 14 to February 20 time frame!

However, competitor-turned-partner MedMen is struggling, to say the least. Just yesterday on Feburary 28, Marijuana Business Daily verified that Multistate cannabis operator MedMen reports $96 million loss:

“California-based MedMen Enterprises, a once-thriving multistate marijuana retailer, released a “grim” quarterly financial report that detailed a whopping $96.4 million net loss in its fiscal 2020 second quarter.

That loss was 49.3% greater than the $64.6 million loss the company reported during the same period in 2018. Its most recent quarter ended Dec. 28, 2019.

On a brighter note, the company, which has marijuana stores in five states, reported that its second-quarter revenues of $44.1 million rose 49.8% from $29.42 million a year earlier.”

3. THEORY: STATE-REGULATED OUTSOURCED DELIVERY

I believe that all of the Florida dispensaries may be required to outsource their delivery to a state-compliant and state-governed delivery service or vendor to be decided at a later date.

- Maybe a state compliant or governed security firm?

Read Moving Green: Cannabis and Hemp Transportation on September 5, 2019 by Natasha Winkler.

- Maybe the “any which way you can” method?

Cannabis store finds a way to deliver where delivery’s not exactly legal on January 16, 2020 by Alex Peters:

“Cannabis delivery services are popular, but questions remain about their legality in many adult-use cannabis states.

For example, in California, where specific delivery license frameworks are in place, cannabis delivery is legal and widely used. Eaze, a San Francisco-based cannabis delivery app, reports that consumers order cannabis every ten seconds via their app.

It was in mid-January 2019 that the Bureau of Cannabis Control in the state of California ruled that marijuana home delivery is permissible for locally approved dispensaries. Marijuana will be allowed to be delivered in communities that are known to have banned the sale of weed. Of course, there are a few critics; some including law enforcement.

Marijuana dispensary owners will have a daunting task getting the weed to the consumers, especially if they have not prepared for it beforehand. On the other hand, the marijuana home Marijuana home delivery will now make it possible for these people to have access to legal marijuana. However, the dispensary has to be legally licensed for marijuana home delivery.”

- Maybe cannabis drones?

On January 20, 2020, Peters returned with Flying high: Are cannabis drone deliveries the future or merely fantasy?

“There’s been a spate of recent speculation about the role drones might play in future cannabis deliveries. The issue resides precariously at the intersection of modern technology, ever-evolving and ever-confusing legislation, and a cannabis industry booming in all directions. Plus, there’s no denying the fact that drones filling the skies with Purple Punch and Sour Diesel is the stuff of so many futuristic fantasies. But is it possible?

As the demand for cannabis steadily grows, so does the need for efficient delivery from business to business. Currently, the sector favors privately-owned van fleets like those utilized by Sasquatch Logistics in Washington.”

- Maybe FedEx, USPS or Amazon?

FedEx, UPS jockey with Amazon as tech giant expands into shipping on September 1, 2019 by Jesse Pound:

FedEx is expanding delivery service to seven days per week all year, but it ended its ground delivery contract with Amazon.

UPS is exploring using drones and self-driving trucks.

Amazon has built up its own transportation network, including a fleet of cargo planes.

The years-long battle between Amazon and retail companies has spilled over into the shipping industry.

FedEx has announced two changes to its relationship to Amazon in recent months, including ending the ground delivery contract with the e-commerce pioneer. Meanwhile, UPS is exploring new technologies, such as drones and self-driving trucks, to modernize its delivery services.

The moves come as Amazon is building up its delivery fleet, renting planes and offering $10,000 to its employees to leave the company and start their own local delivery business.

Amazon started using the U.S. Postal Service more after the delivery companies struggled to deliver packages on time during the 2013 holiday season, Ross said.”

• • • • • • • • • • • • • • •

These predictions are only my opinion and with all the whirlwind of cannabis news flying fast and hard, your guess for the ACTUAL future of these two companies is as valid as mine.

Have at it and we’ll let the nugs fall where they may. I will be here legally medicating in the meantime.

Opinion by Heather Allman, Author

Cannabis Law Report, Publisher