SF Gate

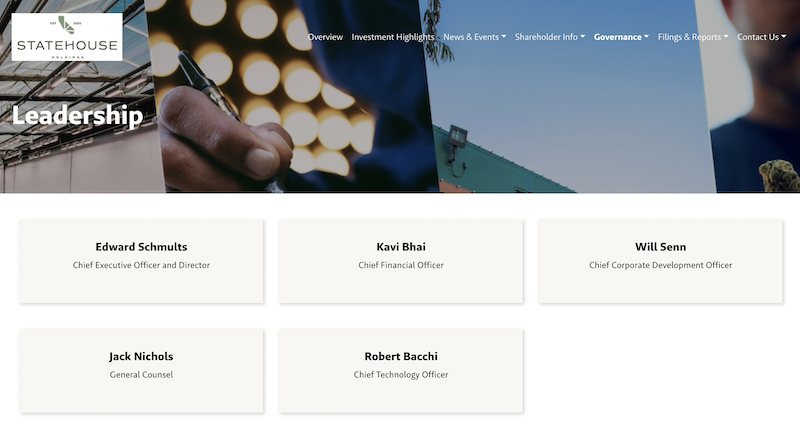

Oakland’s pioneering Harborside cannabis dispensary is probably the most influential cannabis dispensary in America. Founded in 2006, it went on to become the world’s largest dispensary, spawn its own reality show, be defended by members of Congress before weed was legal and eventually pave the way for marijuana legalization.

But on Friday, Harborside is broke. The dispensary has gone from a poster child for cannabis reform to another example of the deep financial woes of the California cannabis industry.

Harborside’s parent company StateHouse Holdings has over $100 million of debt, nearly as much as its total assets. One of the company’s lenders asked a California judge on Thursday to place the company into receivership, according to Green Market Report.

Read this report at

https://www.sfgate.com/cannabis/article/historic-bay-area-harborside-financial-trouble-19798195.php

Just reading the PR precis’ for 2024 gives a good indicator as to where things have been heading

Source: https://www.statehouseholdings.com/news-and-events/news

The GMR report

Pelorus Fund REIT, LLC filed a complaint in a California court Thursday seeking to place StateHouse Holdings Inc. (CSE: STHZ) (OTCQB: STHZF) into receivership.

The move comes after StateHouse defaulted on four existing loans, according to Pelorus. The private mortgage REIT is requesting the immediate appointment of a receiver to take control of StateHouse’s assets and operations.

“We believe that a court-appointed Receivership will better position StateHouse to more effectively produce and deliver high-quality product for the benefit of its key constituents,” Pelorus CEO Dan Leimel said in a statement.

Leimel said the action “is intended to protect StateHouse employees, customers, business partners and vendors, enabling the business to continue to operate across its production and distribution footprint.”

According to a recent analysis by Viridian Capital Advisors, the company has total debt of $122.79 million and tangible assets valued at $123.47 million. In a situation where the company might need to liquidate assets to repay creditors, Viridian estimated the assets could be worth about 80% of their book value, or $98.78 million. In other words, creditors might recover up to 80 cents on every dollar owed.

Viridian noted that StateHouse consistently ranks as one of the weakest credits in their rankings, making the “generous” high potential workout value surprising.