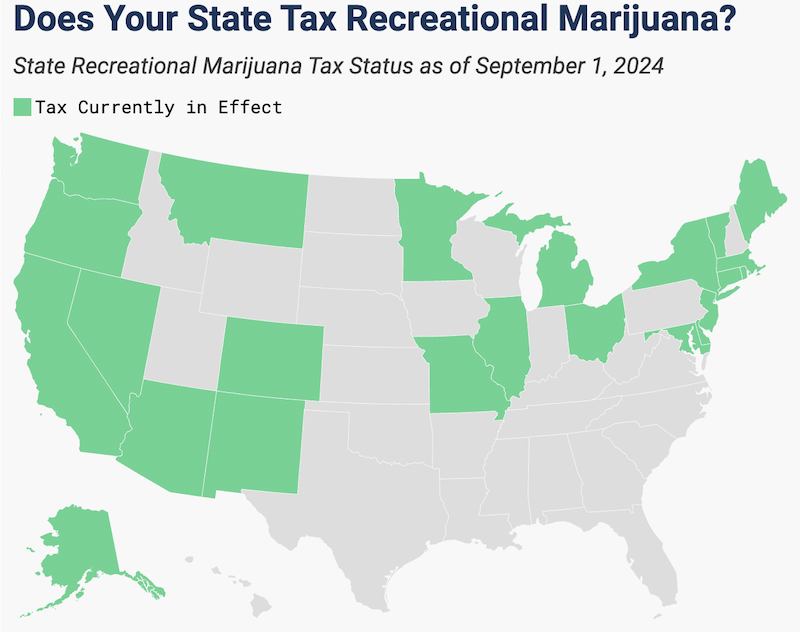

Recreational marijuana taxation is one of the hottest policy issues in the US. Many states have elected to regulate and tax legal marijuana sales and consumption, despite the ongoing federal prohibition. This week’s map shows states that have established a legal recreational cannabis market subject to an excise tax. Legalization shifts consumers to safer legal markets while generating tax revenue for state programs. Harms associated with recreational marijuana are still somewhat under-studied, but as more states allow legal markets, more information will be available to optimize tax design.

Approaches to tax structure vary significantly across states. Some states tax by weight, some by price, and others by THC content. Ad valorem taxes are simpler but are associated with greater revenue volatility and do not target any specific harm-causing element. Ad quantum taxes on weight or quantity produce more stable revenues and better target the harm-causing element, but do not account for potency. Ad quantum taxes based on THC content most directly target the harm-causing element, but the technology to measure THC content is often too expensive to make this option viable yet.

Disparate structures render state-by-state comparisons of rates or overall tax burden difficult. With federal prohibition still in place, interstate commerce remains illegal, which creates a siloed market within each legalized state. Possible federal legalization or defederalization of marijuana policy may encourage harmony between state systems. Taxes on marijuana should be low enough to allow legal markets to compete with illicit markets, thereby reducing individual and societal harm while generating more revenues.

Does Your State Tax Recreational Marijuana?

State Recreational Marijuana Tax Status as of September 1, 2024

State Excise Tax Rates on Recreational Marijuana, as of September 2024

| State | Tax Rate(s) | Notes |

|---|---|---|

| Alaska | $50/oz of Mature Flowers | |

| Alaska | $25/oz of Immature Flowers and Abnormal Buds | |

| Alaska | $15/oz of Plant Trims | |

| Alaska | $1 per Clone Plant | |

| Arizona | 16% on Retail Sales | If a federal excise tax is imposed, AZ caps combined rates to 30% and automatically reduces the state rate to combine to 30%. |

| California | 15% on Retail Gross Receipts | Counties may impose additional excise taxes, which would be included in the gross receipts for the purposes of the state excise tax. |

| Colorado | 15% on Wholesale Average Market Rate | Counties and municipalities can impose additional excise taxes on wholesale transactions, up to 5%. |

| Colorado | 15% on Retail Sales | |

| Connecticut | $0.00625 per milligram of THC in plant material | |

| Connecticut | $0.0275 per milligram of THC in edible products | |

| Connecticut | $0.009 per milligram of THC in other cannabis | |

| Connecticut | $1 per THC Infused Beverage | |

| Connecticut | 3% Municipal Tax on Retail Gross Receipts | |

| Delaware | 15% on Retail Sales | The tax was imposed in April 2023, but sales have yet to actually begin. The Office of the Marijuana Commissioner only began accepting applications for licenses in August 2024. Licenses for cultivation are expected to be issued in November 2024, product manufacturing in December 2024, and retail in March 2025. |

| Illinois | 7% on Wholesale Gross Receipts | Counties and municipalities may impose additional taxes up to 3.75%. |

| Illinois | 10% on Retail Sales of Products with 35% or less THC | |

| Illinois | 20% on Retail Sales of Cannabis-Infused Products | |

| Illinois | 25% on Retail Sales of Products with more than 35% THC | |

| Maine | $335/lb of Flowers | |

| Maine | $94/lb of Plant Trim | |

| Maine | $35 per Mature Plant | |

| Maine | $1.5 per Immature Plant or Seedling | |

| Maine | $0.3 per Seed | |

| Maine | 10% on Retail Sales | |

| Maryland | 9% on Retail Sales | |

| Massachusetts | 10.75% on Retail Sales | Localities may impose additional taxes up to 3%. |

| Michigan | 10% on Retail Sales | |

| Minnesota | 10% on Retail Gross Receipts | |

| Missouri | 6% on Retail Sales | Cities and counties may impose additional taxes up to 3%, which was interpreted by Missouri courts to mean 3% each to total 6%. |

| Montana | 20% on Retail Sales | Counties may impose additional taxes up to 3%. |

| Nevada | 15% on Wholesale Fair Market Value | |

| Nevada | 10% on Retail Sales | |

| New Jersey | $1.24/oz Social Equity Excise Fee | The Social Equity Excise Fee is calculated to be 0.333% of the Average Retail Price, capped per ounce depending on the Average Retail Price up to $10/oz. The rate cap increases if the average retail price decreases. Municipalities may impose additional taxes, up to 1% on wholesale receipts or 2% on cultivator, manufacturer, and retailer receipts, totaling 7% before accounting for pyramiding effects. |

| New Mexico | 12% on Retail Sales | Beginning July 1 2025, the tax is set to increase incrementally 1% per year until reaching 18% in July 2030. |

| New York | 9% on Wholesale Sales | |

| New York | 9% on Retail Sales | |

| New York | 4% Local Tax on Retail Sales | |

| Ohio | 10% on Retail Sales | Legal retail sales began August 2024. |

| Oregon | 17% on Retail Sales | Cities and counties may impose additional taxes up to 3%. |

| Rhode Island | 10% on Retail Sales | |

| Rhode Island | 3% Local Tax on Retail Sales | |

| Vermont | 14% on Retail Sales | |

| Washington | 37% on Retail Sales |

Sources: State Statutes; Bloomberg Tax.

Data compiled by Adam Hoffer, Jacob Macumber-Rosin

2024 Notable Changes

- Minnesota legalized recreational marijuana and taxes sales at 10 percent of retail gross receipts.

- Ohio legalized recreational marijuana and taxes sales at 10 percent of retail sales.

- Delaware established a 15 percent tax on retail sales, but business licensure has yet to be completed, so sales have yet to begin. Retail licenses are expected in March 2025.

- California switched its wholesale-level tax to a tax levied on retail gross receipts.

- New York swapped its specific tax by THC content for a 9 percent ad valorem wholesale tax.

- Planned legalization in Virginia was not authorized by the state legislature, and a subsequent attempt to legalize recreational sales and tax them at 11.625 percent was vetoed by the governor.

Nearly half of US states have legalized the sale of recreational marijuana, and many more have allowed medical marijuana. A few states have decriminalized possession but have not allowed cultivation or sale of marijuana. According to a recent Gallup poll, 70 percent of Americans support legalization—including a majority of every racial, political, age, and regional demographic. Efforts to reform marijuana policy federally have previously been unsuccessful, but new attempts experience increasing support.

The STATES 2.0 Act would defederalize marijuana policy entirely, removing cannabis from the Controlled Substances Act and allowing for interstate commerce between states that decide to legalize marijuana within their jurisdictions. Recent discussions of formally rescheduling marijuana from Schedule I to Schedule III may also have tax implications. Under federal prohibition, “legal” markets in legalized states remain burdened by the inability to participate in interstate commerce, difficulty doing business with banking institutions, and other struggles associated with the unique legal framework.

A significant majority of marijuana consumption occurs via illicit markets. States that impose excessive taxes, require expensive or limited licensure, or otherwise hinder the legal markets they create may not experience significant reductions in illicit consumption. If prices in legal markets are kept higher than illicit market prices, consumers will not be incentivized to switch to safer legal products. Taxes on legalized marijuana should be principled and not so burdensome as to preclude legal markets from effectively competing with illicit markets. Properly designed taxes have the potential to generate billions of dollars in revenue for the states, though it may take some time for these revenues to be realized as legal markets are established.

With interstate commerce prohibited, we don’t yet see problems created by varying tax designs that occur in other legal markets. There are no multi-state businesses that must comply with disparate regulations, and tax arbitrage or double taxation cannot occur. However, if interstate commerce is eventually tolerated by the federal government, the significant differences in tax designs may create negative effects and opportunities for tax avoidance. States should prepare to harmonize their tax designs once interstate marijuana business is allowed—and would be better advised to coalesce around best practices now, before systems become more difficult to reform.

The wide variety of marijuana products and potencies renders taxation complicated. The most efficient option would be to tax by potency (as measured by THC content) where practicable and to tax by weight where THC content is too difficult to measure. This most effectively targets the actual harm-causing element with the tax and minimizes other problems with ad valorem taxes, like volatile revenues. Market prices in legalized markets have tended to steadily decrease, as supply increases and production becomes more efficient, which may erode ad valorem revenues over time. Rates should also be kept low enough to allow new legal markets to compete with existing illicit markets, incentivizing consumers to switch to the safer option while driving revenues to taxable consumption.

Source: https://taxfoundation.org/data/all/state/recreational-marijuana-taxes/