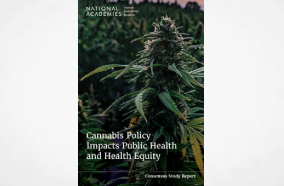

A London-based cannabis company has been granted creditor protection and plans to sell the business amid wide-spread turmoil in the marijuana industry.

Indiva, the leading maker of cannabis-infused edibles in Canada, is the latest Southwestern Ontario pot producer to seek relief under bankruptcy protection laws as it deals with mounting debt. The company revealed in April it had accumulated debt of $71.6 million, according to MJ Biz Daily, a cannabis industry publication.

Indiva announced it has been granted creditor protection this month, which it says gives the company the “time and stability” to consider potential restructuring deals including the sale of the business and its assets.

“Due to, among other things, the fragmentation of the cannabis industry, financial underperformance and pressures resulting from obligations owing to creditors, the Indiva Group has incurred cumulative losses,” the company said in a statement, noting the process won’t affect its operations.

Indiva will seek court approval to sell its business and assets to Alberta-based cannabis and liquor retailer SNDL Inc., an existing creditor and one of its larger stakeholders.

“It is expected that the Indiva Group will emerge from creditor protection as a stronger company with a healthier balance sheet,” the company said.

Indiva and company chief executive Niel Marotta didn’t respond to a request for comment Friday.

A publicly-traded company on the TSC Venture Exchange, Indiva operates a 3,700-square-metre (40,000-square-feet) plant on Hargrieve Road in south London, where it makes and packages cannabis-infused edibles and extracts.

https://lfpress.com/news/local-news/london-cannabis-company-indiva-granted-creditor-protection