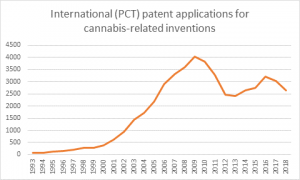

The number of global cannabis patent applications has doubled since 2008, Cannabis Law Report can reveal, as 2019 promises to be a landmark year for marijuana intellectual property.

The World Intellectual Property Organization said approximately 10,246 cannabis-related applications have been filed since 1978 under the Patent Cooperation Treaty (PCT), with 6,137 applications coming after 2008.

Experts say the number could potentially be even higher as firms exploit loopholes to snatch patents related to cannabis such as growing or treating addictions, without expressly referring to marijuana in their application.

Concerns have been raised that larger firms are using their size and power to snatch patents and shore up their positions, while the emergence of “patent trolls” is also causing worry that bad actors will monopolise existing knowledge and attempt to take popular strains out of play.

Europe: Watch This Space

Firms seeking to gain a foothold in Europe’s fledgling medicinal cannabis sector must take leaf from their North American counterparts on intellectual property, said Toronto specialist life sciences patent attorney Micheline Gravelle of law firm Bereskin & Parr, as the market may echo similar struggles of the past.

“Given the international competition in this hugely dynamic and commoditised industry, robust intellectual property protection will be absolutely crucial for European businesses looking to make their mark,” said Gravelle, managing partner of the firm. “As the market evolved in Canada during the 1990s, it was truly eye-opening to see such a patchy understanding of the basics of IP.”

Typically, bigger biotech players with budgets to match are well-versed in the art of protecting their innovations, said Gravelle, but in the rush to bring products to market, smaller startups can find themselves falling short on the fundamentals.

Gravelle said active and rigorous due diligence was one of the most important aspects for any firm looking at the European market, which is projected to be worth more than €115.7bn ($132bn) in the next decade.

“European companies also need to be especially mindful of the international nature of the industry,” said Gravelle. The 90-plus Canadian publicly-listed cannabis companies have market value of about CA$31bn, but the top three filers of patents there are Swiss, US and British businesses.

“Although the Canadian industry is already maturing, it remains uncertain just how swiftly the European market will follow suit,” she added.

Figures provided by: World Intellectual Property Organization

The soaring number of patents has run parallel with the money flooding into the sector over the last decade.

Legal cannabis sales are believed to have hit $10bn in the US in 2018, and are predicted to reach nearly $23bn by 2025, according to Bloomberg Intelligence data sourced from cannabis industry intelligence firm New Frontier Data. CBD sales are expected to quadruple over the next four years, from $535m in 2018 to more than $1.9bn by 2022.

Big Pharma IP Battles

One of the most active filers of cannabis patents is British firm GW Pharmaceuticals, a world-leading biopharma firm and creator of the first prescription medicine derived from the cannabis plant.

According to a recent filing, the company’s IP portfolio at September 30, 2018, includes 82 cannabis-related “family” patents in the US, which it is aggressively seeking to defend.

From those, it owns or licenses 252 pending patent applications worldwide. Within the US it has 48 issued patents, with a further 39 pending patent applications under active prosecution. There are an additional 563 issued patents outside of the US.

The company disclosed it was involved in several IP legal struggles over its landmark drugs, Epidiolex, which uses CBD oil to treat epilepsy, and Sativex, a mouth spray with trace amounts of THC and CBD used to treat, amongst other illnesses, multiple sclerosis.

Two of its recently issued European patents, including a patent claiming the use of CBD in the treatment of partial seizures, have received a notice of opposition, it said, which may result in the patent failing. One of its US patents is involved in a review proceeding before the USPTO that could result in the revocation of the claims.

“If we fail to adequately protect our intellectual property, we may face competition from companies who attempt to create a generic product to compete with Epidiolex or Sativex,” the company said. “We may also face competition from companies who develop a substantially similar product to Epidiolex, Sativex or one of our other product candidates that is not covered by any of our patents.”

GW said many companies have encountered significant problems in protecting, defending and enforcing intellectual property rights in foreign jurisdictions.

“The legal systems of certain countries, particularly certain developing countries, do not favour the enforcement of patents and other intellectual property rights, particularly those relating to pharmaceuticals, which could make it difficult for us to stop the infringement of our patents or marketing of competing products in violation of our proprietary rights generally,” GW said.

GW said it is expecting to put significant sums of cash aside to fight the legal battles.

“There is a substantial amount of litigation, both within and outside the US, involving patent and other intellectual property rights in the pharmaceutical industry,” the company said.

A Potted View of IP

The complex history of cannabis legalisation means securing IP rights is never straightforward, and in the case of the US, where most of the business activity is taking place, the situation is extremely messy.

In the US, cannabis firms cannot use federal trademark protection to shield their brand, as the drug is still illegal at federal level despite more than 30 states giving the green light.

The issue of cannabis as a Schedule 1 narcotic has led to a bizarre situation where the Drug Enforcement Agency (DEA) refuses to downgrade cannabis under the Controlled Substances Act (CSA), yet the US government itself holds a patent on non-psychoactive cannabinoids, most notably CBD, as a medicine.

Patent 6,630,507, titled “Cannabinoids as antioxidants and neuroprotectants” was issued on October 7, 2003, to the United States as represented by the Department of Health and Human Services.

There are three basic types of patent available for cannabis firms to apply for; utility, design, and plant. A fourth, provisional, is linked to utility patents.

Utility patents:

By far the most common patent issued by the United States Patent and Trademark Office, approximately 90 percent of applications are for utility patents, and are issued for 20 years. A utility patent is intended to protect “new and useful” inventions, such as a process, a machine, a manufacturing method, a composition of matter or a similarly new and equally useful improvement of an existing invention.

Smoking devices, or processes for extracting and purifying marijuana and its key ingredients for medical use have been covered with utility patents. It also concerns other cannabis technologies, both recreational and medicinal. The category is extremely broad, making it a popular litigation subject.

Design patents:

Design patents are intended for new, original and ornamental designs that can be used on goods, such as the shape of a smoking device such as a pipe or a bong. They exclude parties other than the owner from using, making or selling the design. The patent is granted for a term of 14 years, and unlike the utility patent, requires no maintenance fees to be upheld.

Plant Patents:

Perhaps the most controversial in regard to cannabis are patents is issued for new, distinct variations of plants invented or discovered through cultivation, mutation, hybridization or any other artificial process. The same exclusive rights are granted as with the other patents, but while the term lasts for 20 years there is no need to pay maintenance fees.

Cannabis IP In Court

The first lawsuit over cannabis intellectual property appeared in July 2018, and has the entire sector on edge. It was filed by United Cannabis Corporation (UCANN) against Pure Hemp Collective (PHC), both Colorado corporations, in federal court.

The case concerned allegations that Pure Hemp’s tinctures, gel capsules, vape pens, and other cannabis products infringe one or more claims of UCANN’s patent for “cannabis extracts and methods of preparing and using same.” (US Patent No. 9,730,911.)

“The case has major implications on two fronts,” said David Gold, of Cole Schotz PC. “First, the enforcement of the UCANN patent specifically; and second, the overall viability of litigation concerning cannabis-related patents.”

At the industry level, Gold said, a decision to validate and enforce a rather broad patent could determine whether UCANN will be able to strongarm anyone else in the industry using a liquid cannabinoid formulation containing 95 percent cannabidiol (CBD).

More broadly, it is the first infringement suit concerning a patent on a cannabis-related product that, while patented, is used with a federally illegal. There are questions over the ability of the court to hear the case, as a result.

“Absent a quick settlement, it is difficult to conceive of any outcome, whether it be at the motion to dismiss stage or at trial, that will not send shockwaves through the industry,” said Gold. “Who those shockwaves impact most remains to be seen.”

The cannabis industry has reached an important milestone, said Rod Kight, cannabis legal expert and author of the Kight On Cannabis blog. “Truly novel inventions should be granted protection from infringement,” he said. “This incentivizes and promotes advances in the field. However, patent ‘land-grabs’ that are broad in scope and based on inventions which existed but were not well documented are a blight on on the industry and will stall advances.”