Founder Arnau Valdovinos posted the following to Linked In on 6 Nov 2024

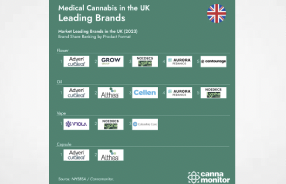

Cannamonitor’s analysis of 300,000+ privately prescribed items from 2022 to 2023 offers unparalleled insights into the UK emerging market and its competitive landscape:

Curaleaf Laboratories leads the Market: Adven has emerged as the dominant player across the flower, oil, and capsule categories.

Challenger Brands: GROW® Pharma , Lyphe, Aurora Europe GmbH, and Cantourage UK make strides in the flower market, while Althea UK, Cellen, and VIOLA Brands are competitive in extracts.

New Entrants and Exits: Emerging brands with still limited sales in 2023 include MAMEDICA®, Therismos Limited, and Little Green Pharma. Some, like Columbia Care, have exited the market.

In addition to profiling the top players, the report features in-depth analyses of over 25 active brands, providing insights into market share, segmentation, top products, sourcing and supply chain dynamics, and more.

This report was a monumental effort, with 14,000 raw prescription records meticulously reviewed and enriched with third-party data.

The result is a 150+ page resource packed with hundreds of charts, and actionable insights—an invaluable tool for anyone in or entering the UK medical cannabis market. Here’s what you can expect:

Detailed segmentation of the Flower market by THC levels

️ In-depth analysis of Oil prescriptions by cannabinoid concentration

Insights on cartridges and disposable Vapes

Assessment of Capsules, pastilles and softgel prescriptions

I hope these findings will facilitate market development by empowering data-driven strategies in the industry.