Why are we including this in our breaking news section ? Not so much what’s being said, rather who is saying it.

Proactive Investor writes,

Recent developments have indicated that new treatments derived from these mind-altering substances are garnering new attention from the investment community

Say the word “psychedelic” and most people will immediately conjure up images of tie-dyed hippy types taking magic mushrooms.

However, recent developments have indicated that new treatments derived from these mind-altering substances are garnering new attention from the investment community.

On Thursday, Berlin-based biotech called ATAI Life Sciences secured around US$43mln (£36.8mln) in a funding round, valuing the firm at around US$240mln, making it the largest company in the space.

Founded in 2018, ATAI finances clinical trials for drugs that incorporate psychedelic compounds that could potentially be used to treat mental health disorders.

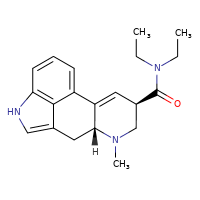

These include ketamine, often used for pain relief and sedation, and psilocybin, the active ingredient in magic mushrooms.

ATAI currently owns Perception Neuroscience, a company developing therapies for neuropsychiatric diseases (e.g. eating disorders), and is the largest stakeholder in Compass Pathways, a firm looking at psilocybin- based therapy for depression.

Echoes of cannabis

Much like cannabis before it, psychedelic compounds have often been maligned by mainstream society for their connection with recreational drug use.

However, again like cannabis, there is a growing body of evidence that the chemicals could be used to treat various mental health problems.

There have also been some encouraging signs from regulators around the use of the substances.

Last October, Compass Pathways received a ‘Breakthrough Therapy’ designation from the US Food and Drug Administration (FDA) for its psilocybin depression therapy.

A ‘Breakthrough Therapy’ is defined as a drug having preliminary clinical evidence that shows it may demonstrate a substantial improvement over options that are currently available to patients.

While this may not be an immediate sign for investors to turn on the money tap, it does help smaller biotech companies get their foot in the door when it comes to raising money as potential investors might take the view that the regulatory approval process would likely be simpler or expedited.