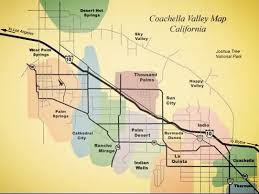

To get a sense of laws in each city at a glance, see the chart at

and more detailed summaries of city policies……

Cathedral City

Cathedral City allows dispensaries, cultivation, manufacturing and testing.

Taxes: The city charges cultivators $15 per square foot of cultivation space. All marijuana sales are taxed at 10 percent. Additionally, there is a tax of 40 cents per gram of cannabis concentrate and unit of cannabis-infused product that is manufactured in the city.

Fun fact: In response to concerns from residents about how many dispensaries were popping up in town, in May 2017, the city council voted that all new cannabis facilities would have to be located in the largely vacant portion of the city north of Interstate 10.

Read more: Cathedral City bans future pot dispensaries south of I-10

Coachella

Coachella allows medical cannabis cultivation, manufacturing and testing. It bans pot retail sales and deliveries, but is considering a proposal to allow delivery services and pot dispensaries in a portion of downtown.

Taxes: Cannabis businesses must pay up to six cents on the dollar of their gross receipts and up to $15 per square foot of space they use for cultivation or manufacturing.

Fun fact: Coachella is weighing a plan to turn Grapefruit Boulevard in the city’s downtown into a cultural district with cannabis retailers, restaurants and music.

Read more: Downtown to remain target area for cannabis retail in Coachella

Desert Hot Springs

Desert Hot Springs allows it all – cultivation, manufacturing, testing and dispensing.

Taxes: The city taxes cultivators $25 per square foot of cultivation space for the first 3,000 square feet and $10 per square foot for any additional cultivation space after that. The city also levies a 10 percent tax on all marijuana sales.

Fun fact: Desert Hot Springs was one of the first cities in the state to adopt a municipal permitting process for cultivation and has become known as Southern California’s marijuana Mecca.

Read more: ‘Bud and Breakfast’? Desert Hot Springs spa trying to make pot tourism experience happen

Indian Wells

Indian Wells is practically pot-less. Both medical and adult-use marijuana activity – including dispensaries, cultivation, manufacturing, testing and delivery services – are prohibited in the city.

Taxes: Since no cannabis businesses are allowed, there’s no tax structure.

Fun fact: Indian Wells requires residents to register with the city and pay a $141-a-year fee if they want to grow marijuana at home for their personal use. People can grow up to six plants and have to keep them out of sight and out of smelling range from the outside world. The rule raised eyebrows among marijuana advocates and attorneys, who told The Desert Sun in 2016 that Indian Wells’ permitting requirement went “significantly beyond” what state law allows.

Indio

No one can sell, manufacture, test, process or grow pot in Indio, even patients or primary caregivers that grow marijuana for medical purposes. Deliveries into or out of the city are also banned.

Taxes: Since no cannabis activity is allowed, there’s no tax structure.

Fun fact: Indio was the second desert city to completely ban medical marijuana, following Indian Wells.

Read more: No pot sale, cultivation or delivery for Indio, committee advises

La Quinta

You can’t have a pot business in La Quinta, unless it’s a medical marijuana delivery service that is licensed with the city, nor can you grow your own marijuana as a patient or primary caregiver. Deliveries are restricted to qualified patients at residences or residential care facilities for the elderly.

Taxes: La Quinta has not established taxes for delivery services, but they are subject to fees.

Fun fact: La Quinta changed its stand on delivery in March 2017, seeing deliveries as a way to meet the needs of residents without lifting a ban on dispensaries and cultivation.

Read more: Delivery of medical marijuana in La Quinta OK’d by council

Palm Desert

In October 2017, the Palm Desert city council lifted a ban on dispensaries and up to six retail operations will be allowed. None have opened yet. The city also allows testing, manufacturing and commercial cultivation.

Taxes: No municipal tax structure has been set up yet.

Fun fact: The city council will allow one pot shop to open up on El Paseo Drive –sometimes called the Rodeo Drive of the Desert – as long as it is east of Larkspur Lane.

Read more: On El Paseo, one marijuana retailer will be allowed as Palm Desert lifts marijuana sales ban

Palm Springs

Palm Springs was an early adopter of medical cannabis cooperatives. Until recently, the city had capped the industry at six dispensaries. To prepare for recreational cannabis, the city has removed the cap and is accepting applications for new businesses, though there are distance requirements between dispensaries to prevent oversaturation. The city also allows cultivation, testing and manufacturing.

Taxes: Palm Springs voters passed measure E in November, which set the tax rate for recreational cannabis at the same rate as medical marijuana. The city charges a flat 10 percent tax on all pot sales and $10 per square foot of cultivation space.

Fun fact: The city will allow cannabis lounges where pot can be consumed on site. The lounges could stand alone – like a pot bar – or be attached to another business such as a dispensary, art gallery, yoga studio or restaurant that doesn’t serve alcohol.

Read more: ‘Prohibition is over’: Palm Springs paves the way for recreational marijuana use

Rancho Mirage

Rancho Mirage does not allow dispensaries or commercial cultivation. After Proposition 64 passed, the city revisited its cannabis ordinances to make them stricter and also banned manufacturing and testing. However, the city does allow delivery and residents can grow up to six plants in their homes, as long as the plants aren’t visible from the street.

Taxes: Since no commercial cannabis activity is allowed, there’s no municipal tax structure.

Fun fact: The city in 2014 resumed a program that gives a $25-per-month stipend to residents that leave town to buy medical marijuana.

Read more: Rancho Mirage pot laws revised after Prop. 64 passage

Mecca, Thermal and Riverside County

The county prohibits all cannabis businesses. That means no dispensaries, no deliveries and no commercial cultivation in all unincorporated areas of the county, like Mecca and Thermal. Personal consumption and personal cultivation of up to six plants is permitted.

Taxes: Since no cannabis businesses are allowed, there’s no tax structure.

Fun fact: Riverside County is reconsidering its stance on pot. It is developing an ordinance that would regulate and tax marijuana businesses like dispensaries and cultivation facilities.