Joshua has worked in the nascent Australian regulated cannabis sector and in this, the first of 4 articles he is writing for Cannabis Law Report, he looks at the realities of trying to value medical cannabis markets in Asian countries.

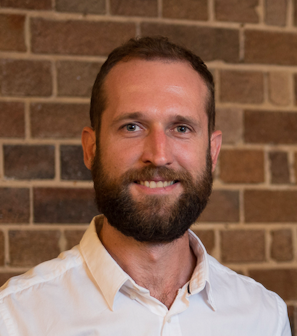

Authored By: Joshua Schmidt MBA

As we see cannabis and hemp companies rise and fall, hire and fire, what is evident is that the nascent nature of the global cannabis industry makes it one of intrigue and immense potential too.

With the first green rush now abating and seemingly gone, my commentary isn’t disproving the “what”, it’s more about seeking out the “how.”

Amidst the volatility of the global cannabis market, there is a need to understand more than just the quantitative aspects as each new jurisdiction is unique in its own right. After all, it is the regulators and health care practitioners that will dictate the ease of patient access in medical markets, not the ever-changing market estimates of size, patients and value provided by third party publishers who all gain their data from the same official and semi official sources.

So how does one see through the numbers when the numbers used in financial models are simply coming from intelligence reports?

A leading publication estimates that the value of a markets will reach a certain figure by 2024 or 2028, and these assumptions are being used to validate financial models, which are being presented to banks for financing.

It is interesting to note that Asia, which is projected to have a market value exceeding US$8.5 billion by 2024[1], is viewed as having strong export market potential for Australian producers, however the legalities of the region have yet to be established.

Furthermore, the Thai central Government has seized control of the industry in that country, preventing foreign companies from entering the market. So, if Thailand is closed, what’s the real value to outside companies or service providers? And what if others follow suit? It’s time to dig deeper, and for that to be communicated.

So my question is then: with so much ambiguity and a lack of clarity around regulations, how much credence can actually be given to estimated value of Asian markets for Australian companies?

We need for companies to present the actual incentive to import Australian product into the region, and their strategy to achieve this. When speaking about the regulators, we need to understand the market specific conditions, and how companies can achieve their goals,rather than simply listing the value in market facing statements.

Rather than speaking to the mere value of particular markets or regions, and assuming a “slice of the pie”, it is important to understand the regulations within these regions, before simply figuring to attain a position within the market.

For both pundits and investors alike, it is about having more confidence in the market valuation and more importantly, their future returns.

The more we know, the more confident we can be.

In part ii of this series, I will look at the European marketplace, and the potential of the market, versus the reality.

Contact Joshua

Joshua Schmidt is a New York-based MBA and cannabis entrepreneur who has gained considerable experience working in the Canadian and Australian Cannabis industries, achieving company exit by acquisition in 2018 in Canada, before establishing and managing the intelligence framework for an Australian cannabis company.

joshua.schmidt(at)vinnovatepl.com

[1] https://prohibitionpartners.com/2019/05/10/three-things-we-learned-from-the-asian-cannabis-report/