This is what they are saying

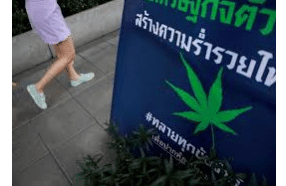

Known for its harsh anti-drug policies, Thailand became the first country in South East Asia to legalise medical cannabis in 2018, with the legislation passing in February 2019.

Building on this, the new rules will allow the growing of plants at home in Thailand – after notifying local officials – but still punish the commercialisation of cannabis without proper permits. However, cannabis extracts with a concentration of tetrahydrocannabinol (commonly referred to as ‘THC’ and the compound that gives a high) of more than 0.2% will not be allowed.

“The decriminalisation and delisting are more for household growers: people who aren’t looking to use the plant for transactional purposes but rather for personal consumption,” says Thanisorn Boonsoong, CEO of Eastern Spectrum Group, one of the leading companies in Thailand that cultivates cannabis for medical and wellness purposes.

Cannabis looks promising for wellness tourism

In 2020, 8.6% of Thailand’s GDP came from agriculture, forestry and fishing, according to the World Bank, while tourism accounted for up to 18% of the country’s GDP before the Covid-19 pandemic.

Also before Covid-19, GlobalData predicted “health and wellness tourism numbers in Thailand will increase to 27.7 million by 2022, representing a compound annual growth rate of 5.6% from 2019”. It added that it expected the country to become a key destination within Asia for health and wellness tourism.

Carl K Linn, a cannabis reform policy analyst and author of a newsletter on cannabis in Thailand, says that “there has been no opposition to legalisation anywhere. The government has promoted it and the public’s response has been positive without exception.”

However, Linn adds that there is confusion on what the reform will look like in reality and that at the moment foreigners who possess cannabis will be arrested.

This strengthens the argument that the government is mainly looking at giving a push to Thailand’s medical tourism industry, according to Pattranist Boonsoong, Eastern Spectrum Group’s marketing manager.

“Given the government’s push for medical tourism – and the fact that the tourism industry is due for some rejuvenation anyway – cannabidiol [CBD] products that complement medical tourism could be a big winner,” she says. “This could range from the obvious – medicines and supplements – to the more peripheral – aromatherapy, candles, massage oils and spa products that can be used as a wellness offering in hotels.”

Boonsoong adds that it is important to bear in mind that the production of cannabis medicines and supplements in Thailand is “highly regulated and only certain producers, namely hospitals and pharmaceutical companies, will be able to fully commit and explore this space”.

Thailand’s first-move advantage in the Asian cannabis market

Some in the country are voicing hopes that this change in legislation could help Thailand with its pandemic recovery, as its economy was severely damaged by Covid-19, with GDP in 2020 falling by 6.1%, according to the World Bank.

Local cannabis mogul Julpas Kruesopon, known in Thailand as ‘Mr Weed’, expressed a hope to see the country become “the Silicon Valley of cannabis in Asia” in an interview with the Washington Times, given that it is pioneering cannabis-positive legislation in the region.

Boonsoong adds: “As one of the first countries in the region to legalise the growth, sale and consumption of cannabis, Thailand has the first-move advantage. This legislative support, coupled with our rich legacy as an agricultural powerhouse, primes Thailand as a leader in the cannabis space.”

In order to become a global hub for cannabis, Boonsoong highlights the importance of establishing local infrastructure to “truly leverage hemp as a cash crop”, while “the support of other industries such as pharmaceuticals, food and beverages, herbal and cosmetics and skincare will be essential in bolstering hemp’s value chain, creating consumer awareness, and establishing an ecosystem where hemp becomes an accessible product”, she adds.

Farmers and the agriculture sector, in general, will also be key to the development of a cannabis industry in Thailand, says Boonsoong, who stresses the importance of “educating and helping local agriculture integrate hemp into their crop cycles”.

Another advantage, according to Boonsoong, is that Thailand can manufacture finished goods for export at a low cost. “It is promising for us to become a regional manufacturing hub of CBD products, exporting goods to Japan, Australia and Europe,” she adds.

Of course, hurdles are also on the horizon. Boonsoong explains that getting the dosage right in products will be a challenge given the stringent regulation.

Establishing an ecosystem of domestic cannabis research and development (R&D) will also be crucial. “Given that the industry is still incredibly nascent here, there is also a lack of product R&D from local entities as well as a lack of local clinical research,” she says. “Most, if not all, scientific literature used is foreign,” adds Boonsoong, who goes on to explain that as the industry matures Thailand will “begin to see local journals and studies, which will be incredibly helpful”.

Thailand holds great promise in many sectors, from agriculture to tourism and pharma, but perhaps inevitably it is the country’s moves to get ahead in the cannabis market that are capturing global headlines. Thoughts of Bangkok becoming a South East Asian equivalent of Amsterdam will have to be put on hold, however, given the country’s insistence that the move is about making the country a wellness and medical hub, rather than a stoner’s paradise, for now, at least.

High expectations surround Thailand’s new cannabis legislation