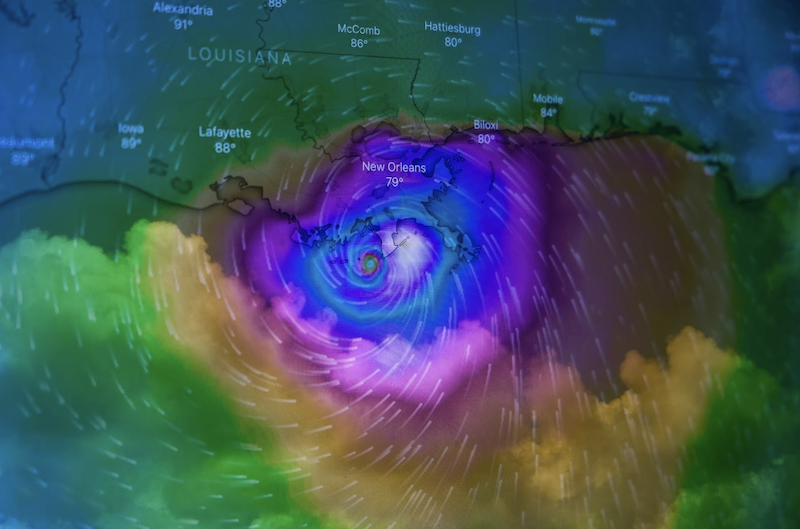

Filing a hurricane damage claim can be a daunting and often overwhelming process. In the aftermath of a devastating storm, it’s crucial to navigate the claim process with care to ensure you receive the compensation you deserve. Unfortunately, many homeowners make common mistakes that can delay their claims or reduce the amount of their payout. This guide aims to highlight the mistakes you should avoid when filing a hurricane damage claim, providing you with valuable tips and insights to make the process as smooth and efficient as possible.

Document All Damages Thoroughly

After a hurricane, it is essential to meticulously document all damages to your property. Start by taking comprehensive photographs and videos of the affected areas, including interior and exterior damage, as well as any damaged personal belongings. Visual evidence is crucial when filing a claim, as it provides proof of the extent of the damage and supports your request for compensation.

Make detailed notes of each damaged item, including descriptions and approximate values. Having a written record alongside your visual documentation can make it easier for the claims adjuster to understand the scope of the damage. Keep receipts and invoices for any emergency repairs or temporary lodging expenses, as these can also be included in your claim. Look for a New Orleans hurricane lawyer or a lawyer in your area to assist you with documenting your damages and filing your claim. Not only can they provide legal expertise, but they can also ensure that you do not miss any crucial details in your documentation.

Avoid Delaying the Claim Process

Time is of the essence when it comes to filing a hurricane damage claim. Delays can result in complications and potentially jeopardize your ability to receive full compensation. Contact your insurance company as soon as possible after the storm to inform them of the damage and initiate the claim process.

Procrastination can also lead to secondary damages, such as mold or further structural issues, which may not be covered if you fail to act promptly. Promptly reporting and addressing damages ensures that your claim is processed quickly and that you can start repairing your home sooner.

Review Your Insurance Policy Carefully

Before filing a claim, take the time to thoroughly review your insurance policy. Understanding the terms, conditions, and coverage limits of your policy can help you avoid unexpected surprises during the claim process. Pay special attention to deductibles, exclusions, and any specific requirements for hurricane-related claims.

Knowing the details of your policy can also empower you to advocate for yourself if there is any disagreement or confusion with your insurance company. If you lack clarity on any aspects of the policy, do not hesitate to ask your insurance agent for an explanation.

Don’t Discard Damaged Items Prematurely

While it might be tempting to start cleaning up immediately after the storm, avoid discarding damaged items until they have been thoroughly documented and inspected by your insurance adjuster. Removing evidence of damage can complicate the claim process and reduce the likelihood of receiving adequate compensation.

Instead, move damaged items to a safe area where they can be easily inspected. In some cases, your insurer may require you to keep certain items until the claim is fully settled to verify the damage and its cause.

Obtain Professional Estimates for Repairs

Engage qualified contractors to provide professional estimates for the necessary repairs to your property. Having expert assessments not only gives you an accurate understanding of the repair costs but also serves as credible documentation to support your claim.

Professional estimates can prevent insurance companies from undervaluing the damages and ensure that you receive a fair settlement. Make sure to obtain multiple estimates and provide these to your insurance adjuster to negotiate the best possible outcome.

Communicate Regularly with Your Insurance Adjuster

Effective communication with your insurance adjuster is key to a smooth claim process. Keep a record of all interactions, including phone calls, emails, and in-person meetings. Document the name, date, and summary of each conversation to maintain a clear timeline and reference point.

Being proactive in your communication can help clarify any misunderstandings and keep your claim moving forward. If there are any delays or issues, do not hesitate to follow up and request updates on the status of your claim.

Seek Assistance from a Public Adjuster

Navigating the intricacies of a hurricane damage claim can be challenging, and seeking the assistance of a public adjuster can provide valuable support. Public adjusters work on behalf of the policyholder, ensuring that you receive a fair assessment and compensation for your damages. They are experienced in dealing with insurance companies and can help you manage your claim more effectively, from initial documentation to negotiating settlements.

Hiring a public adjuster can also relieve some of the stress and burden associated with the claims process. They can handle the complex details, allowing you to focus on recovering and rebuilding. Make sure to choose a reputable and licensed public adjuster with a track record of successful claims to maximize your chances of a favorable outcome.

Be Prepared for Potential Disputes

Despite your best efforts, disputes with your insurance company may arise. It’s important to be prepared for these potential disagreements to ensure you receive the compensation you deserve. Familiarize yourself with your rights as a policyholder and be ready to present all evidence supporting your claim, including photos, videos, receipts, and professional estimates.

In the event of a dispute, consider seeking legal advice or representation. An attorney specializing in insurance claims can provide guidance and advocate on your behalf. They can help mediate discussions with your insurance company, ensuring that your interests are protected and that you receive a fair resolution. Being prepared for potential disputes can save time and frustration in the long run, ultimately leading to a more satisfactory claim experience. It’s important to remember that you have the right to fight for a fair and just resolution, and seeking professional assistance can greatly improve your chances of success.

By avoiding these common mistakes when filing a hurricane damage claim, you can navigate the process with confidence and increase your chances of receiving fair compensation. Remember to document all damages thoroughly, act promptly, review your insurance policy carefully, keep damaged items, obtain professional estimates, communicate effectively with your adjuster, seek assistance from a public adjuster if needed, and be prepared for potential disputes. With careful preparation and diligence, you can ensure that your home is restored to its pre-storm condition and receive the financial support you need to recover.