Bloomberg

In what’s been hailed by many as a major step forward for cannabis patient rights, Washington state will pause its 37% excise tax on cannabis for medical cardholders for five years starting June 6, 2024.

Allowing a sales and excise tax exemption on special, high-cost cannabis products puts Washington in a unique position. By removing both taxes, Washington appears to be placing a lower tax burden on patients compared to other states. (Colorado charges sales tax but no excise tax on medical sales, for example, while California exempts card-carrying patients from sales tax but charges them excise tax.)

However, no other adult-use state requires patients to purchase specially tested cannabis to qualify for their medical discount. This places an increased financial burden on Washington’s medical patients who are often those least able to afford it.

The state’s medical patients will have to pay higher product costs to qualify for the tax relief, raising questions of the impact’s significance. But there still may be significant savings opportunities for patients and new business opportunities for Washington’s dispensaries. The 37% reduction, combined with the 6.5% savings on sales tax that already exists, may be enough to spark a resurgence in medical cannabis sales.

Dispensary Opportunities

The tax savings achieved through eliminating the excise and sales taxes may be enough to attract medical patients back to the certified medical brands that offer viable alternatives to pharmaceuticals.

In addition, consumers who are sensitive to toxins, pesticides, and heavy metals—and willing to pay a premium for organic products in other areas of their lives—may provide dispensaries with a new, broader market. These consumers would have to obtain a prescription from their physician, but the excise and sales tax savings of 43.5%, combined with the health advantages of such high-quality cannabis, would be a strong incentive to go through the state’s medical cannabis process.

Up until now, the excise tax charged by Washington state has been a strong deterrent to medical cannabis purchase. Department of Revenue data shows that sales-tax-exempt sales of medical products continue to fall and currently make up only 0.9% of cannabis product sold.

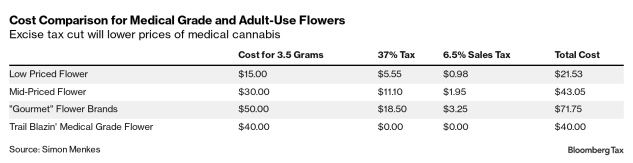

An informal price analysis recently conducted in the Seattle area compared adult-use flower to a well-known brand of medically compliant flower. It showed that the cost savings with excise tax and sales tax removed will cause the medical-grade flower to be far cheaper than the high-end brands and cost-comparable to the most popular, mid-priced brands.