Salvaging Equity Programs – this is our fourth article relating to the impact of the COVID-19 crisis on the cannabis industry. This will not be our last article on this topic. We initially anticipated only four, but we now see additional issues.

The immediate impact of this crisis was obvious. The long-term impact of this crisis and the related depression is not at all clear. Businesses large and small are attempting to adjust to an uncertain future. The cannabis industry has always involved more uncertainties than most industries. The COVID-19 crisis added a layer of uncertainties that are the grist for additional articles.

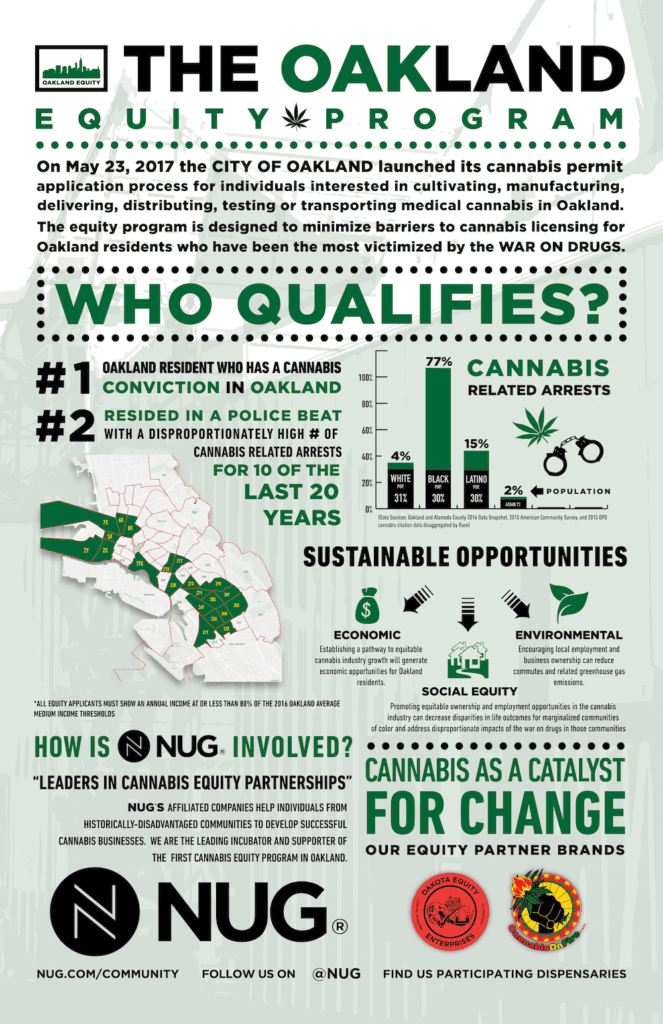

This article focuses on the “Cannabis Equity Programs” a number of local jurisdictions have established. These programs are largely the product of a politically driven social policy. Cannabis Equity Programs attempt to remedy inequities that flowed from the “War on Drugs” that immorally injured so many.

In this article we will describe how the information we presented in the first three articles can be utilized to accomplish the goals of these Equity Programs. The principles we described in these first three articles can be utilized by all cannabis businesses to increase profitability. The principles we have described for increasing the profitability of any cannabis business provide even larger benefits when these principles are utilized in an Equity Program.

Cannabis Equity Programs invariably involve support for the establishment of cannabis businesses owned by economically disadvantaged individuals. Preferences relating to licensing along with various forms of economic subsidies are generally provided to those individuals who qualify to participate in such programs.

The City of Oakland’s Cannabis Equity Program was one of the first such programs. The bedrock concept for Oakland’s Program was a limitation on the number of non-equity cannabis business licenses to the number of Equity cannabis business licenses. Oakland placed no limit on the number of cannabis business licenses the City would issue except for cannabis dispensaries. Equity applicants were given financial subsidies and licensing preferences. Preferences in the issuance of licenses to non-equity applicants were given to those non-equity applicants that sponsored and subsidized applicants that qualified under Oakland’s Program.

Oakland was very successful in issuing cannabis business licenses. Oakland has issued more cannabis business licenses per capita than most California jurisdictions. The vast majority of these licensed cannabis businesses, whether Equity or non-equity, have not been successful. A license is an essential requirement for the operation of a legal cannabis business. Success in a cannabis business requires far more than a license.

Oakland encouraged and subsidized the proliferation of Equity cannabis businesses but failed to provide the support and assistance necessary for such businesses to succeed. Oakland’s Cannabis Equity Program is failing because most of the cannabis businesses that Oakland licensed had no financial advantages and were lacking in business skills. Oakland’s Equity Program can utilize the principles we described in the first three articles to give its Equity cannabis businesses financial advantages if it can provide the necessary training and education.

The principles we have described in the first three articles provide enhanced financial rewards when they are utilized to benefit a local community rather than to make money for investors. As a consequence, these principles are especially beneficial when used in an Equity Program. It is far easier to generate quality jobs for the members of a local community than it is to make successful entrepreneurs out of those same individuals.

Oakland’s Cannabis Equity Program was designed to fail, although this design flaw was wholly unintentional. Oakland’s Program encourages and subsidizes the entry of under-resourced businesses into a highly competitive industry that already has too many participants. Many well-capitalized and well-organized cannabis businesses will fail. What is the likelihood of success for an under-resourced business in such an environment? Success in such an environment requires far more than a license and a modest financial subsidy.

The preceding is the foundation for understanding how shifting Oakland’s approach to its Equity Program will allow it to accomplish far more than it will accomplish if it does not change course. The COVID-19 pause is forcing all governmental agencies to reconsider their programs and priorities. Oakland’s leadership can seize the opportunity this crisis has created. Oakland is uniquely positioned to use the principles we described in the three preceding articles to establish itself as the epicenter of California’s legal, tax-compliant cannabis industry.

Oakland has a once in a lifetime opportunity to establish a top-to-bottom, cultivator to consumer, wholly legal, fully tax-compliant cannabis industry. Oakland’s Cannabis Equity Program can utilize local community ownership and control to create an industry that can successfully compete with conventional cannabis businesses. Conventional business structures have to make money for investors. Equity cannabis businesses can successfully compete with conventionally structured businesses because Equity status can be utilized to make these businesses financially more efficient.

The present crisis is the most significant opportunity Oakland has seen in this century. A substantial portion of California’s underground cannabis industry is already conducting business in Oakland. Oakland can utilize its Cannabis Equity Program to convert its already existing outlaw industry into a wholly legal, fully tax-compliant industry that can effectively compete with conventional cannabis businesses. Such a course of action will bring money into Oakland from elsewhere in California.

It will be difficult for some to understand why such a radical change in Oakland’s utilization of its Equity Program is required. It is likely it will be even more difficult to secure the political support that is required for such a radical change. Such a change is contrary to one of the major political forces that produced the present state of California’s cannabis industry – the belief in an opportunity to make money.

California has struggled with legalization for multiple reasons.

We have written about some of these issues. [Major Cannabis Tremors!] One substantial reason California encountered difficulties with legalization was a well-established, quasi-legal cannabis industry. California is still struggling with the conversion of its underground cannabis industry into a legal, regulated industry. This struggle will continue for the foreseeable future. [Reboot in 2020!!]

We have slightly accelerated the publication of this article as a consequence of Hillary Bricken’s publication of “L.A. Cannabis Update: Little Fires Everywhere” on May 28, 2020. Los Angeles is twenty times larger in population than Oakland. In every aspect, including problems, the cannabis industry in Los Angeles is more than twenty times larger than the cannabis industry in Oakland. The same bodies of federal and California law, however, apply both to Los Angeles and to Oakland.

Oakland faces many of the issues that have hampered California as well as Los Angeles. Oakland is far better situated than either to convert its underground cannabis industry into a wholly legal, fully tax-compliant cannabis industry. Oakland can utilize its Equity Program to facilitate such a conversion. The principles we described in the three preceding articles can be utilized through the Equity Program to provide those involved in Oakland’s underground industry with the same financial benefits they are presently achieving through an outlaw industry. The difference for Oakland and for the participants in such a conversion is that the financial benefits following the transformation of Oakland’s cannabis industry will come from wholly legal, fully tax-compliant businesses.

It is false and misleading to classify cannabis businesses as

“legal” or “illegal,” or as “licensed” or “unlicensed.”

All California cannabis businesses fall under a Bell Curve that stretches from 100% legal to 100% illegal. No Oakland cannabis business is likely to be more than two standard deviations from the center of that Bell Curve in one direction or the other. Most are within the first standard deviation. Oakland’s non-equity cannabis businesses, its Equity cannabis businesses, and its underground cannabis businesses are competing for the same consumer dollars. All fall under the same Bell Curve of California cannabis businesses.

We are publishing this article to describe some resources California’s Equity Programs have that few realize they have that facilitate such a conversion. The chaos in California’s cannabis industry coupled with the “pause” to address the COVID-19 crisis have created an opportunity for Oakland to convert its existing cannabis industry into a wholly legal, fully tax-compliant industry that can effectively compete with both conventional cannabis businesses and underground cannabis businesses.

There are provisions in the tax laws as well as in California’s cannabis laws that can be utilized to create a financial advantage for an Equity cannabis business over a non-equity cannabis business engaged in precisely the same business function. Equity businesses can exploit the tax laws and regulatory laws for the benefit of cultivators, employees and consumers involved with these businesses far more easily than non-equity cannabis businesses. Oakland can utilize its Equity Program for the benefit of its residents far more easily than any other California city. We have written this article for the benefit of Oakland as well as those Emerald Triangle cannabis cultivators who are already positioned to provide supplemental raw material for Equity cannabis businesses in East and West Oakland.

The impact of the COVID-19 induced depression is different for every country, for every industry, and for every community. For some industries this depression is a train-wreck, e.g., sports entertainment. For some industries this depression is merely disruptive and requires some adjustments to systems, processes and operating procedures, e.g., professional services. For other industries this depression has created an expansion opportunity, e.g. package delivery services. Oakland and its Equity Program fall into this third category.

We addressed planning for the conduct of business in a post-COVID-19 cannabis industry in our second and third articles. Our second article introduced Cannabis Consumer Cooperatives as the most financially efficient structure for the operation of a dispensary. Our third article described how to maximize financial efficiency in the movement of cannabis from cultivator to consumer. Oakland’s Cannabis Equity Program, and comparable programs elsewhere including Los Angeles, are uniquely able to exploit the principles described in our three earlier articles to accomplish the goals of these programs.

In our third article we described four different types of Cannabis Consumer Cooperatives: (1) for-profit, adult-use Cannabis Consumer Cooperatives; (2) nonprofit, adult-use Cannabis Consumer Cooperatives; (3) for-profit, medical Cannabis Consumer Cooperatives; and (4) nonprofit, medical Cannabis Consumer Cooperatives. [“Cannabis Tax Management”]

Each of these four types of Cannabis Consumer Cooperatives provides a different set of financial benefits.

If you compare the total combined financial benefits of these four structures for the owners, operators and consumers, the total benefits increase as you move from (1) to (4). A comparison of the benefits that can be achieved through these four different structures illustrates how they can be utilized by Equity Programs.

The distribution of medical cannabis has a financial advantage over adult-use cannabis because no Sales Tax is imposed on medical cannabis. In many jurisdictions the local taxes rates on cannabis are lower for medical cannabis in comparison to adult-use cannabis. There are also some regulatory benefits for medical cannabis as compared to adult-use cannabis that can be utilized for financial advantage. Nonprofit business activities have an advantage over for-profit business activities because the owners of the businesses do not directly profit as owners.

Suppose the tax savings from the sale of cannabis to consumers through a medical dispensary in comparison to an adult-use dispensary are 12%. Stated differently, a medical dispensary can sell cannabis to its customers for 12% less than an adult-use dispensary, and the owners and employees make the same amount of money. Further suppose that the owners of a for-profit dispensary, whether medical or adult-use, make an average 12% before-income tax profit as owners from the cannabis sales. If these additional potential savings are taken into account, a nonprofit medical dispensary can sell cannabis to its customers for 24% less than a for-profit dispensary selling the same cannabis to its customers. In such an instance all of the employees of the cannabis businesses involved as well as the cannabis cultivators make the same amount of money, but consumers save 24%.

The preceding illustrates there is at least a 24% financial advantage available for cannabis businesses that are established through Oakland’s Cannabis Equity Program if it helps these businesses exploit this advantage. The 24% differential is solely for purposes of illustration. In some of our earlier articles we pointed out that the financial advantages of tax minimization can reduce consumer prices by almost 40% with the cultivators making twice as much money.

The savings created through financially efficient operating structures need not be wholly passed-on to consumers. Owners can take some of these savings and still under-cut competitors who are utilizing less financially efficient structures. It is for this reason conventional for-profit cannabis businesses can utilize the information in our first three articles to improve their financial efficiency. Equity cannabis businesses can do even better than conventional cannabis businesses.

Oakland does not need struggling small cannabis businesses that are trying to survive. The residents of East Oakland and West Oakland need good-paying jobs. Oakland’s Equity Program can utilize the tax and regulatory advantages of medical cannabis and nonprofit organizations to establish a cannabis industry in Oakland that has a competitive advantage vis-a-vis California’s for-profit cannabis industry. Such businesses will not only survive, they will thrive. They will thrive because they have a competitive advantage. East and West Oakland as communities will benefit because the residents of these communities are the owners of these businesses whether directly or indirectly.

It will make little difference for a resident of West Oakland to make $90K per annum owning and running a small cannabis business in comparison to being paid $90K per annum for running a nonprofit medical cannabis business sponsored by Oakland’s Equity Program that is engaged in the same business activity. The latter business, however, has a far greater likelihood of long-term success than the former. Oakland’s Cannabis Equity Program, however, can do far more than create good jobs.

Oakland’s cannabis industry extends from cultivation to consumption. Cultivation in Oakland is extensive. It is almost exclusively indoor cultivation. In our third article we described how a Cannabis Cooperative Association (“CCA”) could be utilized to maximize the financial efficiency of the movement of cannabis from cultivator to dispensary through a minimization of the impact of taxes. [[ In that article we noted that some of the benefits CCAs have been overlooked. One of the benefits of CCAs that we did not mention in our third article is the utilization of a CCA by indoor cannabis cultivators.

Oakland’s Cannabis Equity Program has the opportunity to use one or more CCAs to create a cannabis industry consisting largely of Equity cannabis businesses. All of these cannabis businesses will be more financially efficient than those cannabis businesses operated outside the umbrella of a CCA based on Equity businesses. Oakland’s Equity Program has the opportunity through CCAs to establish cannabis businesses that are so financially efficient they can compete with underground businesses.

We can see a couple of potential flaws in the preceding for Oakland. It is not obvious Oakland’s politics will allow the City to pivot in this manner. It is not clear the City Administrator is capable of such radical change. We believe the most significant flaw is likely to be the inability of Oakland to provide the information relating to business systems and processes as well as the training in the use of these business systems and processes that is necessary for Equity cannabis businesses to compete in a highly competitive industry.

The benefit to Oakland, of course, lies not in creating Equity businesses that can successfully compete with other Oakland businesses. The benefit to Oakland lies in bringing money into Oakland by successfully competing with cannabis businesses outside of Oakland. Oakland benefits by using its Equity Program to establish cultivators, distributors, manufacturers, and delivery services that bring money into Oakland from other jurisdictions.

The COVID-19 “Pause” has created a once in a decade opportunity for Oakland.

Can Oakland’s Cannabis Equity Program rise to the occasion?