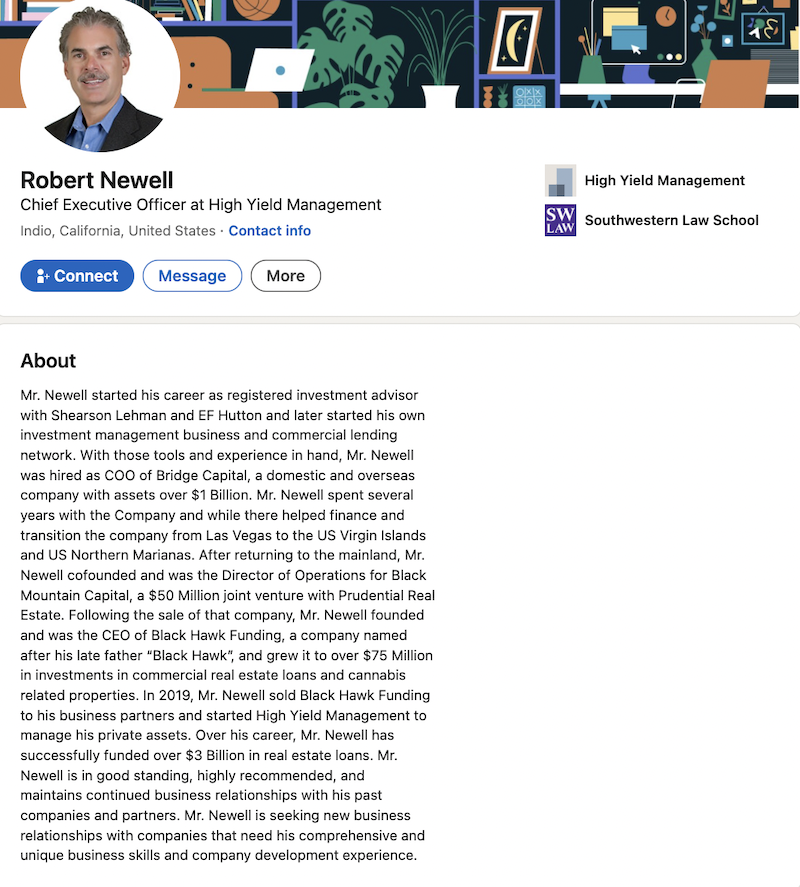

Opalesque Industry Update – On July 22, 2024, the Securities and Exchange Commission charged fund manager Robert Newell and his prior firm, Black Hawk Funding, Inc., with engaging in undisclosed misuses of investor funds, making Ponzi-like payments, and distributing misleading disclosure documents to investors in connection with three cannabis-related private fund offerings.

The SEC’s complaint also alleges that Newell misappropriated at least around $668,000 of investor money. Black Hawk Funding agreed to settle the charges against it.

According to the SEC’s complaint, from November 2016 through at least September 2019, Newell and Black Hawk Funding raised approximately $37 million from over 200 investors across the United States for the disclosed purpose of investing in the cannabis industry. However, rather than using the money as disclosed, Newell, through Black Hawk Funding, allegedly made Ponzi-like payments to pay investors their promised ten percent returns and commingled investors’ money through transfers to other entities controlled by Newell to be used as Newell saw fit. Additionally, the SEC alleges that Newell misappropriated investor funds to benefit himself.

The SEC’s complaint, filed in the U.S. District Court for the Central District of California, charges Newell and Black Hawk Funding with violating Section 17(a) of the Securities Act of 1933 (“Securities Act”); Section 10(b) of the Securities Exchange Act of 1934 (“Exchange Act”) and Rule 10b-5 thereunder; and Sections 206(1), (2), and (4) of the Investment Advisers Act of 1940 (“Advisers Act”) and Rule 206(4)-8 thereunder. The complaint further alleges that Newell aided and abetted Black Hawk Funding’s violations. The SEC seeks permanent injunctive relief against both Newell and Black Hawk Funding, as well as disgorgement with prejudgment intertest, civil penalties, and an officer-and-director bar against just Newell.

Without admitting or denying the allegations in the complaint, Black Hawk Funding has agreed to consent to the entry of a final judgment, subject to court approval: (i) providing permanent injunctive relief under Section 17(a) of the Securities Act; Section 10(b) of the Exchange Act and Rule 10b-5 thereunder; and Sections 206(1), (2), and (4) of the Advisers Act and Rule 206(4)-8 thereunder; and (ii) permanently enjoining Black Hawk Funding from directly or indirectly, including, but not limited to, through any entity owned or controlled by it, participating in the issuance, purchase, offer, or sale of any security.

The SEC’s investigation was conducted by Kashya Shei and John Roscigno, and supervised by Jeremy Pendrey and Jason H. Lee, all of the SEC’s San Francisco Regional Office. The litigation will be led by Sheila O’Callaghan and Ms. Shei.

Article source – Opalesque is not responsible for the content of external internet sites

Robert Newell and Black Hawk Funding, Inc.

U.S. SECURITIES AND EXCHANGE COMMISSION

Litigation Release No. 26053 / July 23, 2024

Securities and Exchange Commission v. Robert Newell and Black Hawk Funding, Inc., No. 5:24-cv-01524 (C.D. Cal. filed July 22, 2024)

SEC Charges Fund Manager with $37 Million Offering Fraud and Misappropriation of Investor Money

On July 22, 2024, the Securities and Exchange Commission charged fund manager Robert Newell and his prior firm, Black Hawk Funding, Inc., with engaging in undisclosed misuses of investor funds, making Ponzi-like payments, and distributing misleading disclosure documents to investors in connection with three cannabis-related private fund offerings. The SEC’s complaint also alleges that Newell misappropriated at least around $668,000 of investor money. Black Hawk Funding agreed to settle the charges against it.

According to the SEC’s complaint, from November 2016 through at least September 2019, Newell and Black Hawk Funding raised approximately $37 million from over 200 investors across the United States for the disclosed purpose of investing in the cannabis industry. However, rather than using the money as disclosed, Newell, through Black Hawk Funding, allegedly made Ponzi-like payments to pay investors their promised ten percent returns and commingled investors’ money through transfers to other entities controlled by Newell to be used as Newell saw fit. Additionally, the SEC alleges that Newell misappropriated investor funds to benefit himself.

The SEC’s complaint, filed in the U.S. District Court for the Central District of California, charges Newell and Black Hawk Funding with violating Section 17(a) of the Securities Act of 1933 (“Securities Act”); Section 10(b) of the Securities Exchange Act of 1934 (“Exchange Act”) and Rule 10b-5 thereunder; and Sections 206(1), (2), and (4) of the Investment Advisers Act of 1940 (“Advisers Act”) and Rule 206(4)-8 thereunder. The complaint further alleges that Newell aided and abetted Black Hawk Funding’s violations. The SEC seeks permanent injunctive relief against both Newell and Black Hawk Funding, as well as disgorgement with prejudgment intertest, civil penalties, and an officer-and-director bar against just Newell.

Without admitting or denying the allegations in the complaint, Black Hawk Funding has agreed to consent to the entry of a final judgment, subject to court approval: (i) providing permanent injunctive relief under Section 17(a) of the Securities Act; Section 10(b) of the Exchange Act and Rule 10b-5 thereunder; and Sections 206(1), (2), and (4) of the Advisers Act and Rule 206(4)-8 thereunder; and (ii) permanently enjoining Black Hawk Funding from directly or indirectly, including, but not limited to, through any entity owned or controlled by it, participating in the issuance, purchase, offer, or sale of any security.

The SEC’s investigation was conducted by Kashya Shei and John Roscigno, and supervised by Jeremy Pendrey and Jason H. Lee, all of the SEC’s San Francisco Regional Office. The litigation will be led by Sheila O’Callaghan and Ms. Shei.

Last Reviewed or Updated: July 23, 2024

https://www.sec.gov/enforcement-litigation/litigation-releases/lr-26053