They write

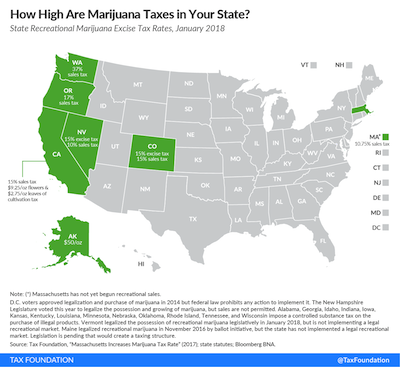

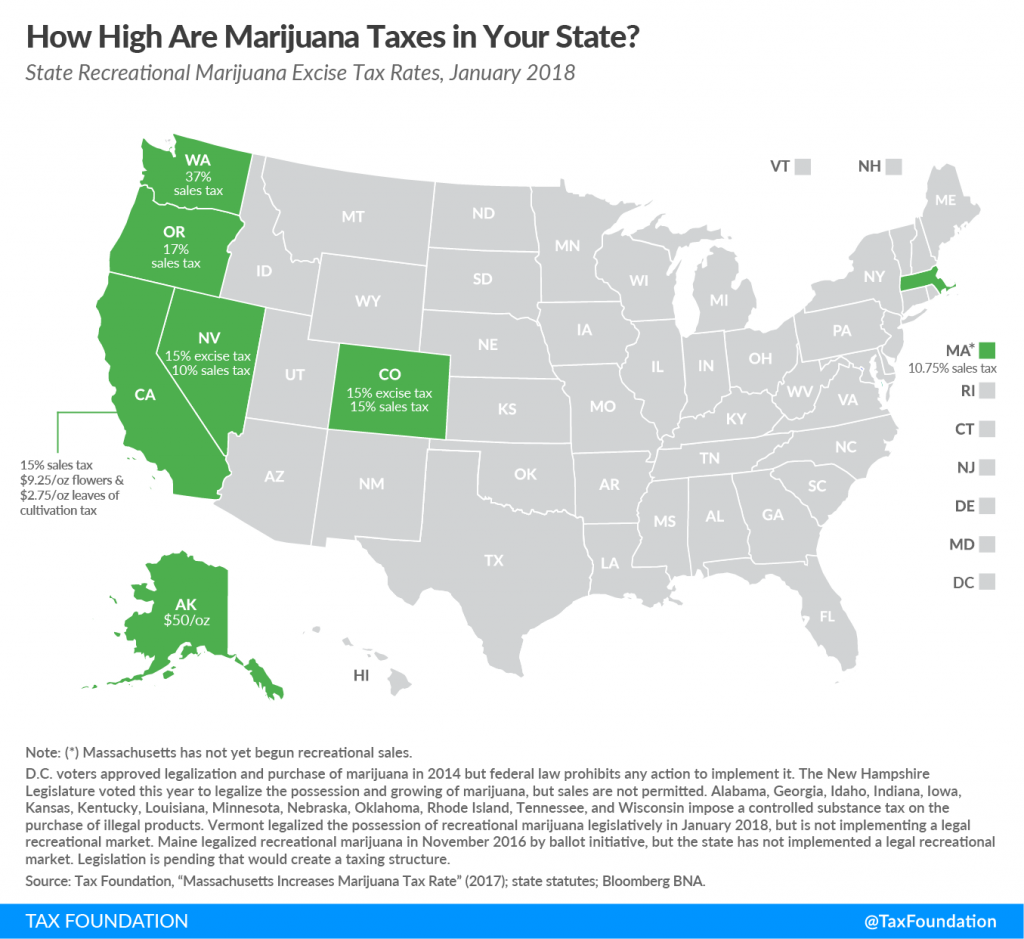

Of the states with legal markets, Alaska is the only state that does not impose some form of sales tax on end-users. In each of the other states, taxes levied on the sale of marijuana far exceed the general sales tax rate levied by that state:

- In Alaska, which has no states sales tax, marijuana growers pay a tax of $50 per ounce when selling the product to marijuana dispensaries or retailers. While the cost of taxes paid is passed on to customers in the form of higher prices, end-users do not pay a sales tax when purchasing marijuana.

- In California, cultivators pay a per ounce of product tax at a rate of $9.25 per ounce of marijuana flowers and $2.75 per ounce of leaves. In addition, retailers collect from customers a 15 percent excise tax on the average market price of the product.

- Colorado imposes a 15 percent excise tax on the sale of marijuana from a cultivator to a retailer. In addition, the state levies a 15 percent sales tax (up from 10 percent in 2017) on retail sales to customers.

- Maine legalized recreational marijuana in 2016 by ballot initiative but has not yet established a legal market. Pending legislation would tax sales of marijuana at a rate of 10 percent and levy an excise tax on cultivators at a rate of $335 per pound of flower, $94 per pound of marijuana trim, $1.50 per immature plant or seedling, and $0.30 per seed. Governor LePage, however, has vowed to veto the legislation.

- Massachusetts, concerned its previous ballot initiative approved rate of 3.75 percent was too low, raised the excise tax rate to 10.75 percent in 2017.

- Nevada imposes an excise tax on the sale of marijuana by a cultivator to a distributor. This rate is set at 15 percent of the Fair Market Value as determined by the Nevada Department of Taxation. In 2017, Nevada created a new 10 percent sales tax paid by consumers.

- Oregon, which does not have a general sales tax, levies a 17 percent sales tax on marijuana.

- Washington levies a 37 percent sales tax on recreational marijuana.

Vermont legalized the possession of marijuana this year but did not create a legal market. D.C. also allows for possessing and growing of marijuana but does not allow for sales in a legal market.

Source: https://taxfoundation.org/state-marijuana-taxes-2018/?mc_cid=b91ced2fec&mc_eid=178dec0b63