Here’s the introduction to her story

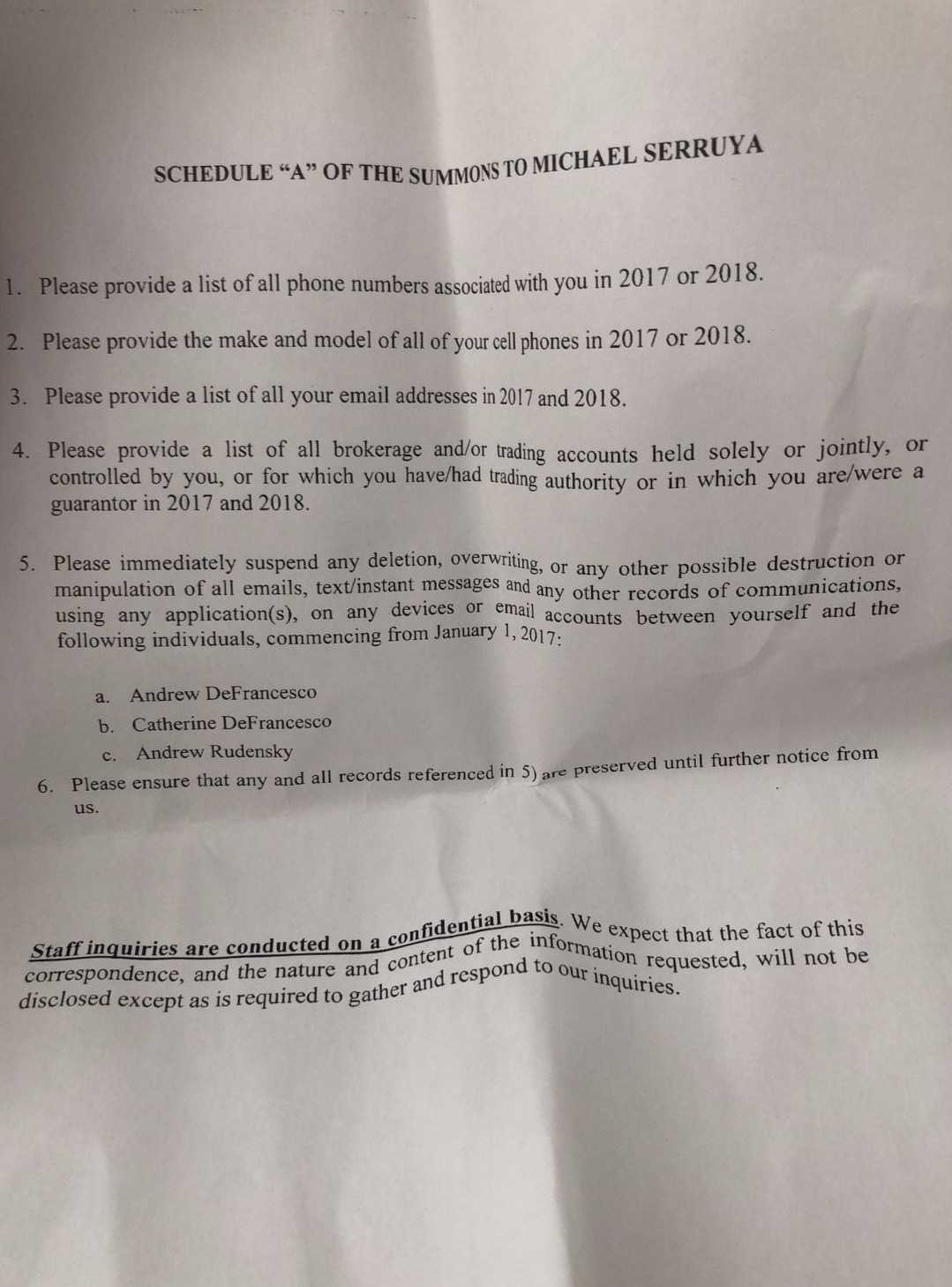

Cannabis Investor and mega Canadian millionaire Michael Serruya was hauled into the Ontario Securities Commission office last year after the Canadian regulator subpoenaed him for an on record interview and demand document production. The securities investigation centered on a Mississauga, Ontario-based coffee shop chain called Les cafés Second Cup. Michael and his brother Aaron Serruya are board members of the company which trades on the Toronto Stock Exchange under $SCU,TO and the OTC Markets. The subpoena demanded communications from Andy Defrancesco and his wife Catherine along with a broker Defrancesco worked with named Andrew Rudensky.

…/…

Serruya made news this year when he was tied to Defrancesco in self dealing cannabis farm acquisitions with Aphria ($APHA).

Read the full story at

Canadian Regulator Demanded Michael Serruya turn over Defrancesco Communications: $SCU.TO

DOCUMENTS

I’m a professional financial investigative journalist who has written for the Greenwich Time, Hearst CT Newspapers, Forbes Magazine, Fortune.com, The Atlantic.com, New York Magazine, New York Post, Trader Monthly, Housingwire, ML-Implode, The Business Insider, Long Island Business News, Dealbreaker, New York Observer, Bitcoin Magazine, DealFlow Media, SIRF.org and more. For the last five years I have been a contributing reporter for Market Nexus Media who publishes a financial trade publication called Growth Capital Investor.

I earned my breaking/investigative news chops reporting during the financial crisis in 2008 for the Sunday edition of the New York Post. I was one of the first to report on the missteps at IndyMac that lead to government investigations and lawsuits against the banks founders. Caught hedge funds like Carrington Capital abusing investors without disclosing conflicts of interest with senior RMBS bond holders; they were sued by Wilbur Ross for Civil RICO. I exposed Bear Stearns misleading their own investors and monoline insurers on the quality of the loans in their mortgage-backed securities, which led to a fraud lawsuit against JP Morgan/Bear Stearns and the $13 billion settlement with the DOJ in 2013. Since 2010 multiple Wall Street firms, that my reporting warned about first, have been [JP Morgan, SpongeTech, Security Savings Bank, SAC Capital, Palm Beach Capital Management, New Stream Capital, NIR Group/Cory Ribotsky, Bear Stearns RMBS Traders, Mike Perry IndyMac CEO, Steven Muehler and the Nanocap MarketPlace, Barry Honig and The Frost Group] investigated or charged for financial violations by the FBI/SEC/State AG or shut down by bank regulators.

The Huffington Post named me the number three most dangerous financial journalist for being willing to challenge the establishment and inform readers best. I’m working on trade-marking “Smashmouth Journalism”

Read More About Teri’s Work At: https://www.teribuhl.com/about/